Six Timeless Tenets of Extraordinary Banks

Brought to you by nCino

If you want to understand innovation and success, a good person to ask is Jeff Bezos, the chairman and CEO of Amazon.com.

If you want to understand innovation and success, a good person to ask is Jeff Bezos, the chairman and CEO of Amazon.com.

“I very frequently get the question: ‘What’s going to change in the next 10 years?’ And that is a very interesting question,” Bezos said in 2012. “I almost never get the question: ‘What’s not going to change in the next 10 years?’ And I submit to you that that second question is actually the more important of the two, because you can build a business strategy around the things that are stable in time.”

In few industries is this truer than banking.

Much of the conversation in banking in recent years has focused on the ever-evolving technological, regulatory and operational landscapes. The vast majority of deposit transactions at large banks nowadays are made over digital channels, we’re told, as are a growing share of loan originations. As a result, banks that don’t change could soon go the way of the dinosaurs.

This argument has merit. But it also needs to be kept in perspective. Technology is not an end in itself for banks, it’s a means to an end – the end being to help people better manage their financial lives. Doing this in a sustainable way calls for a marriage of technology with the timeless tenets of banking.

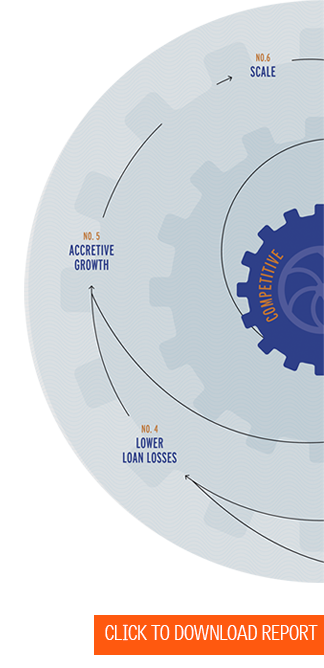

It’s with this in mind that Bank Director and nCino, a provider of cloud-based services to banks, collaborated on a new report, The Flywheel of Banking: Six Timeless Tenets of Extraordinary Banks.

The report is based on interviews of more than a dozen CEOs from top-performing financial institutions, including Brian Moynihan at Bank of America Corp., Rene Jones at M&T Bank Corp. and Greg Carmichael at Fifth Third Bancorp. It offers unique and invaluable insights on leadership, growth, risk management, culture, stakeholder prioritization and capital allocation.

The future of banking is hard to predict. There is no roadmap to reveal the way. But a mastery of these tenets will help banks charge ahead with confidence and, in Bezos’ words, build business strategies around things that are stable in time.

The Six Tenets of Extraordinary Banks

Jonathan Rowe of nCino describes the traits that set exceptional banks – and their leaders – apart from the industry.

To download the free report, simply click here now.