Revisiting Growth, Strategy in the Face of Banking’s Known Unknowns

It’s time to hunker down.

For the last several quarters, the banking industry has been whipsawed by rapid changes in the economy due to the coronavirus pandemic, as well as the response required to keep the fallout at bay. They worked with borrowers to offer widespread deferments, rolled out the Small Business Administration’s Paycheck Protection Program loans and regraded their loan portfolios. With much of that activity winding down, institutions are getting back to the basics of block-and-tackling banking, and bracing for a prolonged period of muted loan growth and sustained low interest rates.

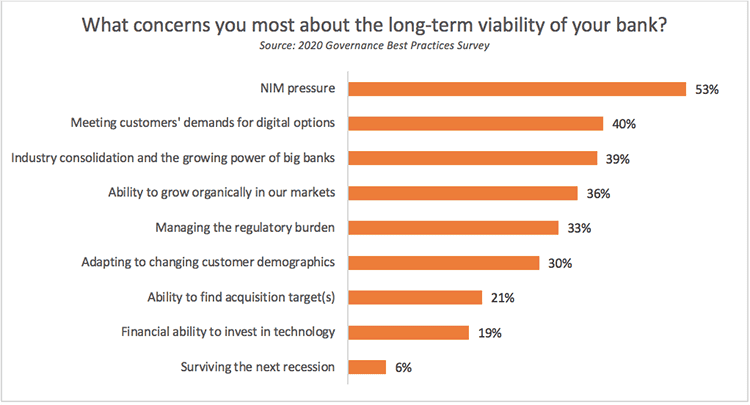

In this environment, the risks can sometimes seem more numerous than the opportunities. In response, banking experts weighed in on how institutions can craft a resilient and flexible strategy while planning for future growth during the first day of Bank Director’s 2020 BankBEYOND experience. Net interest margin compression, keeping up with customer demand for digital offerings and continued industry consolidation topped the list of long-term viability concerns for the CEOs and board members responding to Bank Director’s 2020 Governance Best Practices Survey; organic growth was not far behind. Notably, that survey was conducted in February and March, before Covid-19 spread through the U.S.

While loans deferrals have declined, Hovde Group Chairman and CEO Steve Hovde says he still expects to see “credit quality issues, reserve issues” emerging in the fourth quarter and into 2021, depending on whether lawmakers allocate more stimulus. He also touches on the forces compressing NIMs and what banks can do to address it.

One way that bank leaders can address these concerns is by revisiting the fundamentals of operational excellence as they craft strategies to grow and maneuver safely in this challenging landscape. People, processes and vision are the building blocks of an effective board, says Jim McAlpin, a partner and global leader of Bryan Cave Leighton Paisner’s banking practice group – but these are also the building blocks of an effective bank. Directors should be vigilant in the role they play of engaging in risk oversight and management, McAlpin says, given that they can have a “significant impact” on the bank’s risk appetite.

On the funding side, banks should reconsider how they will amass and defend their core deposit base efficiently, given the decline in branch traffic and increasing digital channel activity. Community banks need to keep their customers engaged as they continually strengthen their digital experience. They should focus on existing customers, listen to what they want, leverage data to identify and understand clients, and maintain their service cultures by personalizing interactions.

“Shut the back door, rather than worry about what’s coming in the front door,” says Bob Reggiannini, a senior manager at Crowe.

But in positioning themselves for growth, McAlpin adds that banks should ensure they have the right type of people at their institutions and on their boards. Diversity in this environment is a strength, given the perspectives and approaches that can come from individuals representing a variety of demographics, identities and backgrounds. In our recent Governance Best Practices Survey, 52% of respondents agreed that greater diversity, defined by race, gender and ethnicity, improves the performance of a corporate board; only 8% said no. Nearly 40% of respondents said they had several members who fit that definition of diversity, and another 30% said they had one or two but wanted to recruit more.