On the Docket of the Biggest Week in Banking

Think back to your days as a student. Who was the teacher that most

inspired you? Was it because they challenged your assumptions while also

building your confidence?

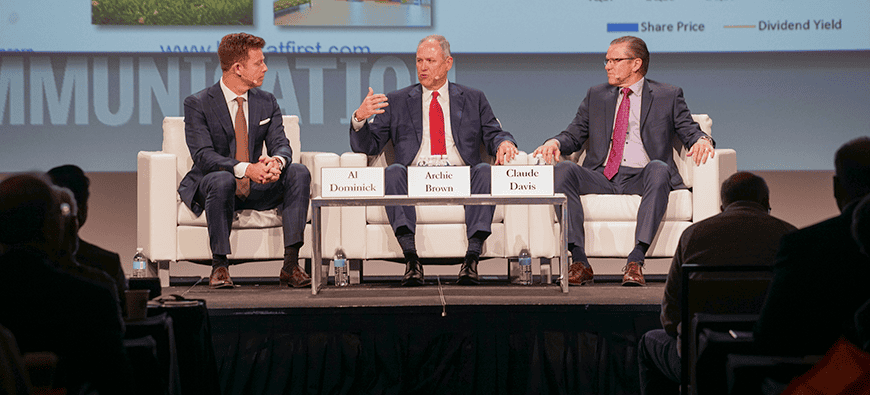

In a sense, the 1,312 men and women joining me at the Arizona Biltmore in Phoenix for this year’s Acquire or Be Acquired Conference are in for a similar experience, albeit one grounded in practical business strategies as opposed to esoteric academic ideas.

Some of the biggest names in the business, from the most prestigious

institutions, will join us over three days to share their thoughts and

strategies on a diverse variety of topics – from lending trends to deposit

gathering to the competitive environment. They will talk about regulation,

technology and building franchise value. And our panelists will explore not

just what’s going on now, but what’s likely to come next in the banking

industry.

Mergers and acquisitions will take center stage as well. The banking

industry has been consolidating for four decades. The number of commercial

banks peaked in 1984, at 14,507. It has fallen every year since then, even as the

trend toward consolidation continues. To this end, the volume of bank M&A

in 2019 increased 5% compared to 2018.

The merger of equals between BB&T Corp. and SunTrust Banks, to form Truist Financial Corp., was the biggest and most-discussed deal in a decade. But other deals are worth noting too, including marquee combinations within the financial technology space.

In July, Fidelity National Information Services, or FIS, completed its

$35 billion acquisition of Worldpay, a massive payment processor. “Scale

matters in our rapidly changing industry,” said FIS Chairman and Chief Executive

Officer Gary Norcross at the time. Fittingly, Norcross will share the stage

with Fifth Third Bancorp Chairman and CEO Greg Carmichael on Day 1 of Acquire

or Be Acquired. More recently, Visa announced that it will pay $5 billion to

acquire Plaid, which develops application programming interfaces that make it

easier for customers and institutions to connect and share data.

Looking back on 2019, the operating environment proved challenging for

banks. They’re still basking in the glow of the recent tax breaks, yet they’re

fighting against the headwinds of stubbornly low interest rates, elevated

compliance costs and stiff competition in the lending markets. Accordingly, I

anticipate an increase in M&A activity given these factors, along with

stock prices remaining strong and the biggest banks continuing to use their

scale to increase efficiency and bolster their product sets.

Beyond these topics, here are three additional issues that I intend to

discuss on the first day of the conference:

1. How Saturated Are Banking Services?

This past year, Apple, Google and Facebook announced their entry into financial services. Concomitantly, fintechs like Acorns, Betterment and Dave plan to or have already launched checking accounts, while gig-economy stalwarts Uber Technologies and Lyft added banking features to their service offerings. Given this growing saturation in banking services, we will talk about how regional and local banks are working to boost deposits, build brands and better utilize data.

2. Who Are the Gatekeepers of Customer Relationships?

Looking beyond the news of Alphabet’s Google’s checking account or Apple’s now-ubiquitous credit card, we see a reframing of banking by mainstream technology titans. This is a key trend that should concern bank executives -namely, technology companies becoming the gatekeepers for access to basic banking services over time.

3. Why a Clear Digital Strategy Is an Absolute Must

Customer acquisition and retention through digital channels in a world full of mobile apps is the future of financial services. In the U.S., there are over 10,000 banks and credit unions competing against each other, along with hundreds of well-funded start-ups, for customer loyalty. Clearly, having a defined digital strategy is a must.

For those joining us at the Arizona Biltmore, you’re in for an

invaluable experience. It’s a chance to network with your peers and hear from

the leaders of innovative and elite

institutions.

Can’t make it? We intend to share updates from the conference via

BankDirector.com and over social media platforms, including Twitter and

LinkedIn, where we’ll be using the hashtag #AOBA20.