Revisiting Funds Transfer Pricing Post-LIBOR

Brought to you by Empyrean Solutions

The end of 2021 also brought with it the planned discontinuation of the London Interbank Offered Rate, or LIBOR, the long-running and globally popular benchmark rate.

Banks in a post-LIBOR world that have been using the LIBOR/interest rate swap curve as the basis for their funds transfer pricing (FTP) will have to replace the benchmark as it is phases out. This also may be a good time for banks using other indices, like FHLB advances and brokered deposits, and evaluate the effectiveness of their methodologies for serving their intended purpose. In both situations, newly available interest rate index curves can contribute to a better option for FTP.

The interest rate curve derived from the LIBOR/swap curve is the interest rate component of FTP at most large banks. It usually is combined with a liquidity transfer price curve to form a composite FTP curve. Mid-sized and smaller banks often use the FHLB advance curve, which is sometimes combined with brokered deposit rates to produce their composite FTP curve. These alternative approaches for calculating FTP do not result in identical curves. As such, having different FTP curves among banks has clear go-to-market implications.

Most large banks are adopting SOFR (secured overnight funding rate) as their replacement benchmark rate for LIBOR to use when indexing floating rate loans and for hedging. SOFR is based on actual borrowing transactions secured by Treasury securities. It is reflective of a risk-free rate and not bank cost of funds, so financial institutions must add a compensating spread to SOFR to align with LIBOR.

Many mid-tier banks are gravitating to Ameribor and the Bloomberg short-term bank yield (BSBY) index, which provide rates based on an aggregation of unsecured bank funding transactions. These indices create a combined interest sensitivity and liquidity interest rate curve; the interest rate and liquidity implications cannot be decomposed for, say, differentiating a 3-month loan from a 5-year loan that reprices every three months.

An effective FTP measure must at least:

- Accurately reflect the interest rate environment.

- Appropriately reflect a bank’s market cost of funding in varying economic markets.

- Be able to separate interest rate and liquidity components for floating rate and indeterminant maturity instruments.

These three principles alone set a high bar for a replacement rate for LIBOR and for how it is applied. They also highlight the challenges of using a single index for both interest rate and liquidity FTP. None of the new indices – SOFR, Ameribor or BSBY – meets these basic FTP principles by themselves; neither can FHLB advances or brokered deposits.

How should a bank proceed? If we take a building block approach to this problem, then we want to consider what the potential building blocks are that can contribute to meeting these principles.

SOFR is intended to accurately reflect the interest rate environment, and using Treasury-secured transactions seems to meet that objective. The addition of a fixed risk-neutral premium to SOFR provides an interest rate index like the LIBOR/swap curve.

Conversely, FHLB advances and brokered deposits are composite curves that represent bank collateralized or insured wholesale funding costs. They capture composite interest sensitivity and liquidity but lack any form of credit risk for term funding. This works fine under some conditions, but may put these banks at a pricing disadvantage for gathering core deposits relative to banks that value liquidity more highly.

Both Ameribor and BSBY are designed to provide a term structure of bank credit sensitive interest rates representative of bank unsecured financing costs. Effectively, these indices provide a composite FTP curve capturing interest sensitivity, liquidity and credit sensitivity. However, because they are composite indices, interest sensitivity and liquidity cannot be decomposed and measured separately. Floating rate and indeterminant-maturity transactions will be difficult to correctly value, since term structure and interest sensitivity are independent.

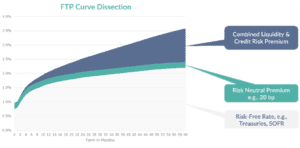

Using some of these elements as building blocks, a fully-specified FTP curve that separately captures interest sensitivity, liquidity and credit sensitivity can be built which meets the three criteria set above. As shown in the graphic, banks can create a robust FTP curve by combining SOFR, a risk-neutral premium and Ameribor or BSBY. An FTP measure generated from these elements sends appropriate signals on valuation, pricing and performance in all interest rate and economic environments.

The phasing out of LIBOR and the introduction of alternative indices for FTP is forcing banks to review the fundamental components of FTP. As described, banks are not using one approach to calculate FTP; the results of these different approaches have significant go-to-market implications that need to be evaluated at the most senior levels of management.