Who Gains the Most From Final Interchange Rule

The Federal Reserve’s final rule released this week on the debit interchange or “swipe” fees that retailers must pay looks like a clear victory for the banking industry, as it will allow banks to charge double what had been previously proposed.

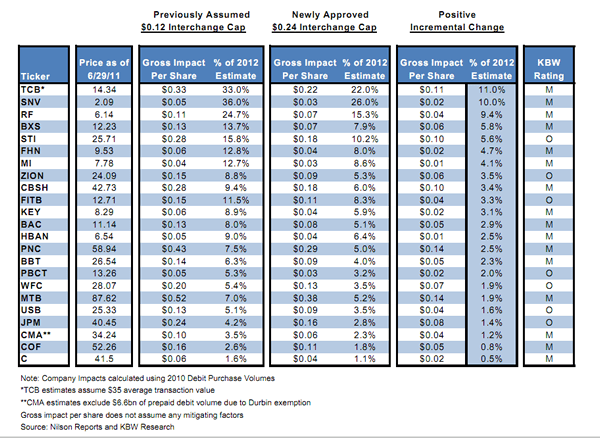

For some, it’s more of a victory than for others. Banks that have relied heavily on debit fee income to support their business models, such as TCF Financial Corp. in Minnesota, clearly have more to gain by the change from the proposed rule. The final rule allows banks to charge about 24 cents per transaction, up from about 12 cents under an earlier proposal (both of which include a surcharge for fraud protection).

Banks, thrifts and credit unions with less than $10 billion in assets are supposed to be exempt from the new rule, but it remains unclear whether the marketplace (i.e. Visa and MasterCard) will create a two-tiered system that protects the smaller banks.

An analysis by the research and investment banking firm Keefe, Bruyette & Woods (KBW) this week says TCF Financial Corp. had the most to gain from the change in the proposed rule. If you’ll remember, TCF is the bank holding company that sued the federal government last October over the constitutionality of the interchange rule, otherwise known as the Durbin amendment to the Dodd-Frank Act.

TCF’s stock shot up 4.8 percent from Wednesday morning to early Friday afternoon on the New York Stock Exchange, to $14.40 per share.

KBW’s analysis shows that TCF, which has $18.7 billion in assets, will make 11 cents more per share in 2012 earnings with the change just made to the final rule, all else being equal. That basically means TCF will see its earnings cut 22 cents per share in 2012 instead of 33 cents, as previously proposed. The analysis doesn’t take into account any possible changes to fees, such as an annual debit fee for consumers, that banks may implement to make up for the loss in fees collected from retailers.

Other banks that have the most to gain from changes in the rule, according to Keefe, Bruyette & Woods, include Synovus Financial Corp. in Columbus, Georgia; Regions Financial Corp. in Birmingham, Alabama; and BancorpSouth, Inc. in Tupelo, Mississippi.

Not surprisingly, TCF announced yesterday that it was requesting permission to drop its lawsuit in the U.S. District Court in South Dakota, citing both the Federal Reserve final rule and the fact that it lost an appeal in federal court this week on the matter of a preliminary injunction.

“While we continue to believe that the Durbin Amendment is unconstitutional because it requires below-cost pricing and exempts 99% of all U.S. banks, we believe our lawsuit has served its purpose in demonstrating the unfairness of the Durbin Amendment and that it is time for us to move on,” said William A. Cooper, the company’s chairman and chief executive officer, in a statement. “The Federal Reserve Board’s final rule is an improvement from its initial proposal and recognizes many of the points we made in our case.”