Strengthening Relationships With Credit Score Monitoring

Brought to you by SavvyMoney

Customers want to improve their financial wellbeing and save money. Banks want to create sticky digital relationships.

Here’s something that can help both groups: credit monitoring.

Having a safe and easy way to keep an eye on their credit enhances consumer financial wellbeing in a variety of ways:

- Makes it easier to find and stop fraud. According to the Federal Trade Commission, American consumers lost more than $5.8 billion to fraud in 2021, which was a 70% increase over 2020. When customers have a safe, convenient way to monitor their credit, they’re more likely to uncover and recover from fraud more quickly.

- Helps uncover and correct credit report mistakes. Credit report errors are much more common than many people realize. According to a 2021 Consumer Report investigation, more than a third of consumers who participated in a voluntary credit report check found errors. And these errors are more than a nuisance. Negative impacts can include being uncorrectly charged higher interest rates on a loan or credit card or being turned down for a job or a place to live.

- Can improve credit scores and consumer financial wellbeing. Based on internal research SavvyMoney has conducted with partner financial institutions, we’ve found that consumers who monitor their credit data see strong improvements in their credit scores. Across all score ranges (except the 750 to 850 range), there was a 30% improvement in six months and a 39% improvement in 12 months. In the 300 to 649 score range, the improvements were even more dramatic: 32% in six months and 41% in 12 months.

Score improvement can mean significant savings for bank customers. Most importantly, consumers who improve their score can see a stark difference in interest costs on their loans. According to a study from LendingTree, borrowers with “fair” credit scores, which range between 580 and 669, could end up paying over twice as much interest on personal, auto and student loans, and 97% more on their credit cards.

Most consumers don’t currently monitor their credit. But that could change if they monitor it through your institution. Because credit monitoring is a soft pull, customers can check their credit data as often as they want without any impact to their credit score. That can help them get a better handle on their current financial health and areas where they could improve. And banks can add in personalized education and loan offers based on their score, creating a virtuous cycle of better credit, better lending rates and improved overall financial wellbeing.

Unfortunately, most people don’t monitor their credit. According to LendingTree’s annual customer survey, only a third of American consumers take that step. A big reason why: Consumers are understandably reluctant to provide their personal information.

This is where giving customers access to credit monitoring helps your financial institution too.

Consumers’ reluctance aligns with a key finding from SavvyMoney’s financial institution partners: 75% of users want to be able to check their credit score from inside their trusted financial institution. If their credit data is available through a single sign-on through your financial institution’s online or digital banking, they won’t have to.

Use a credit monitoring service that updates credit files more frequently – the best offer the option of daily updates – allows customers to track if they’ve moved into a new range and be alerted when their most up-to-date score qualifies them for lower rates.

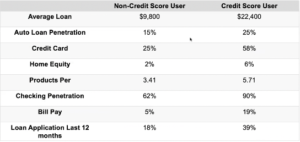

Look for companies with solutions that integrate with your digital banking platform. That allows your customers to safely and easily monitor their credit score right from your online or mobile banking, driving engagement with your website or app. As the chart below captures, that additional engagement can drive an uptick in a wide variety of products and services, including checking penetration, which is often seen as a proxy for primary financial institution status.

Credit monitoring is good for both your customers and your bank. If your financial institution isn’t currently making it easy for customers to check their credit with you, it’s a service worth investigating.