How Banks Can Grab a Slice of the $11 Trillion B2B Pie

Brought to you by Visa

A team of economists at the Federal Reserve has tracked noncash payment trends in the U.S. since 2001, including the number and value of transactions across all major payment methods.

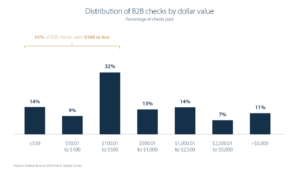

Leveraging their December 2021 Payments Study update, Visa’s Business Solutions team estimates there were 2.9 billion B2B checks for an estimated $11.8 trillion. This represents 26% of all checks paid by U.S. depository institutions and 57% of paid check dollar value, based on the Fed’s 2018 Check Sample Survey. Given the ongoing decline in check use by U.S. consumers, we suspect the B2B share is likely even higher today.

Despite decades of decline in check use, check displacement is still a massive growth opportunity for electronic payments, particularly for commercial card. For context, commercial card rails process an estimated $500 billion in business spend – equivalent to just 4% percent of the value of B2B checks, according to McKinsey & Co.’s U.S. Payments Map estimating 2020 U.S. commercial card spend at $485 billion.

Readers are likely familiar with the traditional challenges to commercial card acceptance by suppliers: card processing fees, manual processing of virtual card payments, accounts receivable reconciliation, among others. These challenges are real, but payments innovators are making strides on these daily. For example, let’s consider the inertia by corporate buyers who write all these checks. According to the Fed’s last Check Sample Survey, 82% of B2B checks were for $2,500 or less; 55% were for $500 or less.

These low-value transactions can be paid via a commercial card, right? Unfortunately, too few buyers feel motivated to pursue these opportunities. Often the return on investment feels too low to track down all the data about where these checks are going and then convince suppliers to accept card. Generating a consolidated spend file may require tapping into multiple systems with disparate data structures. In the end, fewer than half of a company’s suppliers are likely to accept commercial cards. It’s no wonder decision makers don’t jump at the chance when bank salespeople ask for a spend file simply to determine if there’s an opportunity worth pursuing.

A New Operating Model

But what if that weren’t the model? What if we took the burden of finding opportunities away from the corporate client entirely? What if a card salesperson showed up at the door with a credible opportunity already in hand? There’s one model that client banks can tap into that does just that.

Each of the 2.9 billion B2B checks paid every year is paid by a financial institution. Most financial institutions (or their processors) use optical character recognition (OCR) in the daily processing of those checks. By repurposing OCR data from checks, banks can identify which suppliers their corporate customers are paying that already accept commercial card, and then pinpointing which business bank customers have the greatest opportunity to shift check spend with those suppliers to card. These banks’ salespeople no longer begin a client conversation by asking for a spend file. Instead, they present a credible analysis, based on the client’s own payments volume processed by the bank.

What used to be a data mining project for the client becomes a simple, data-driven decision about how to move forward. Banks are in a unique position to approach business customers about these opportunities. Without the deposit relationship, commercial card salespeople must use the old model.

If it sounds too good to be true, it’s not. But it does take work. Some could make the argument that the easy growth in commercial card is over; that commercial card issuers are in a race to the bottom. We are more optimistic than that. We believe there is a tremendous, untapped opportunity out there: an $11.8 trillion pie in the form of 2.9 billion B2B checks.