Giving Banks a Better Way to Cross Sell

Arlene Vogel, vice president of commercial banking services for Central Bancompany, understands missed opportunities firsthand. When she paid for a recent product, she noticed that the store owner was using a credit card processing service that connected to a smartphone. That store’s business checking account was with a Central Bancompany bank.

Arlene Vogel, vice president of commercial banking services for Central Bancompany, understands missed opportunities firsthand. When she paid for a recent product, she noticed that the store owner was using a credit card processing service that connected to a smartphone. That store’s business checking account was with a Central Bancompany bank.

“When I asked why she had signed up with that company, she said, ‘It was just so easy,’” Vogel said. “We missed the opportunity when we opened her accounts because we hadn’t addressed that need. Those companies are marketing a specific product around a specific need. We’re marketing mass products. A lot of it is about capturing the few opportunities you have when you have the customer in.”

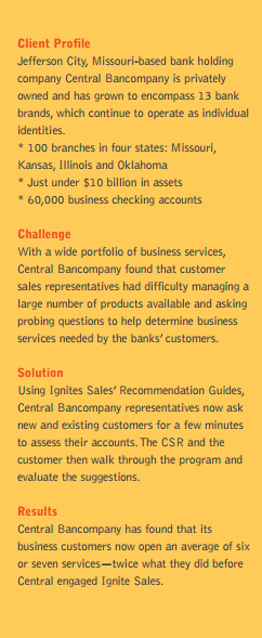

Banks like those under Central Bancompany—a holding company for 13 regional banks in Missouri, Kansas, Illinois and Oklahoma—face missed opportunities like this each day. Banks are under historic pressures, from regulators as well as competitors that focus on one item in a bank’s significant portfolio of services. One may take merchant services while another offers Small Business Administration loans. And those competitors are taking customers away permanently.

But there is another trend that is playing in banks’ favor—if they are able to take advantage of it. Busy business owners prefer to streamline relationships with one vendor—not multiple service providers.

But there is another trend that is playing in banks’ favor—if they are able to take advantage of it. Busy business owners prefer to streamline relationships with one vendor—not multiple service providers.

When Central Bancompany engaged Ignite Sales, it needed to help its front-line associates improve relationships with its business customers. Using Ignite Sales’ Recommendation Guides, the front-line representative now has a tool to better serve business customers while growing its services.

At Central Bancompany’s banks, the customer service representative sits down with the business customer, turns the computer screen where both can see it and logs on to a Central Bancompany-branded page. The business customer answers a series of questions and the program then provides products and services based on those responses.

Central Bancompany initiated the program as a pilot in February 2014. Already, it has doubled the services that a new business customer typically opens from three or four to six or seven.

In many ways, banks are in the early stages of a shift that has happened in all forms of retail in recent years: a proper sales process. Most banks cannot ensure accurate product recommendations across all channels. They are not making recommendations and not tracking what’s being recommended versus what’s being opened. Because these recommendations are not tracked, opportunities for strategic follow-up are lost.

Central Bancompany has taken the initiative to do these things and it is paying off. Not only have its banks seen an increase in the new services opened, but customer sales representatives also say they feel more confident in sharing a full range of products using the program, which is called Business Analyzer.

“Prior to the Business Analyzer, we had products to ask questions around, but our CSRs [customer service representatives] wouldn’t because they were afraid the customers would ask a technical question about the product,” Vogel said. “Now, because these products are recommended in response to questions asked by the analyzer, they have more confidence in explaining it. With a marketing piece that explains the service, the customer is more confident in purchasing.”

Ignite Sales’ is providing Central Bancompany with information about how its CSRs are performing with bank goals as well. Perhaps more importantly, Central Bancompany’s customers are becoming more aware of the range of products available. “It’s been the biggest eye-opener how much our business customers did not realize we could have done for them,” Vogel said. “We’re using the analytics to improve our product design, bundling and pricing. We’re trying to watch particular business types. Is there a standard set of products that they are falling in to? We don’t have the answers on that yet, but we’re doing a deeper dive into cross sales.”

That is consistent with what many of Ignite Sales’ customers find. As they receive better data, they can realign products to what their customers want—not simply model their product line based on what the larger banks in the region offer. It leads to pretty dramatic improvements in the sales process.

And it’s not just for new customers. When Central Bancompany initiated Ignite Sales’ Recommendation Guides, one bank piloted a test around existing business customers. Representatives presented it as a business review. On average, each existing customer opted for at least one additional product.

At a time when competitors are nibbling around the edges of a bank’s customers, increasing existing relationships by one product—and doubling the number of products a new customer selects—can lead to major successes.