Will 2014 Be the Year of M&A?

Many bank merger and acquisition (M&A) experts have predicted for years that consolidation would increase significantly due to pressures from regulatory burdens, lack of growth in existing markets, and aging boards and management teams that are ready to exit.

Many bank merger and acquisition (M&A) experts have predicted for years that consolidation would increase significantly due to pressures from regulatory burdens, lack of growth in existing markets, and aging boards and management teams that are ready to exit.

2014 might be the year when these expectations are realized. While activity the first quarter of 2014 was only slightly ahead of prior years, the second quarter saw a dramatic increase—74 deals were announced, which is the highest of any quarter since the credit crisis of 2008. Annualized, the total number of announced transactions will exceed 260, which is on par with many of the pre-crisis years of the 2000s.

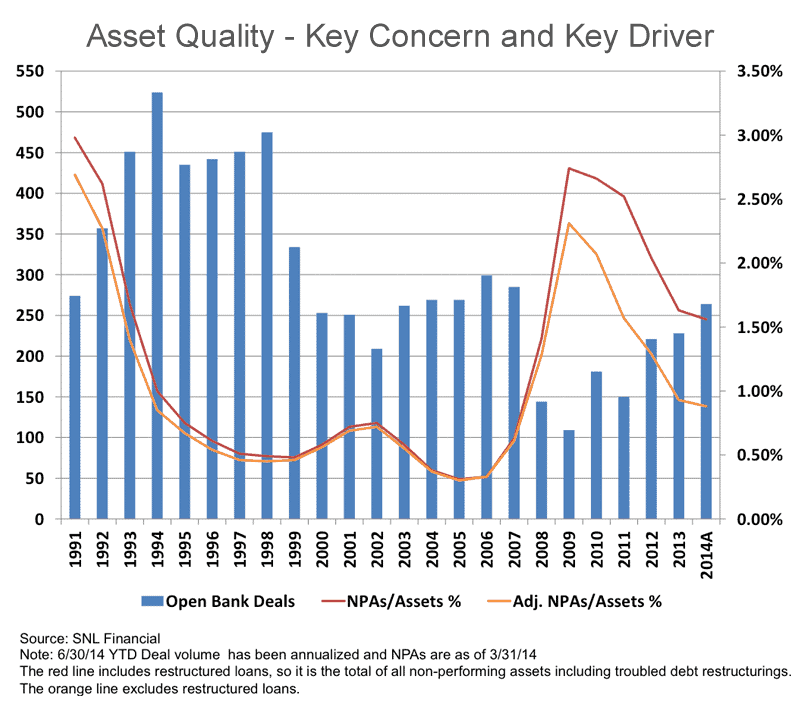

The level of deal volume is below many expectations. However, historical perspective might help clarify why 2014 is shaping up to be a pretty strong year for M&A. From 1991 through mid-2014, the absolute number of deals declined over time, as has the number of available charters to acquire. The percent of charters acquired in any given year fluctuates from between 2.0 percent and 4.5 percent, with a 3.3 percent average over this period. On an annualized basis, 2014 will be close to the high of 4.5 percent, which means that 2014 could be a very good year based on the number of available charters. Regardless of any future predictions, one fact seems clear: The banking system has a capacity for a certain number of transactions in any given year, and it might be that the industry’s current pace is the maximum number of deals in a year given the number of available targets.

What has been driving deal volume in 2014? The first focus is credit quality in the industry. As illustrated in the following chart, credit quality has continued to improve industrywide, which is directly correlated to deal volume. When credit quality is poor, deal volume decreases; when credit quality improves, deal volume follows suit.

Pricing is another issue that affects deal volume. Obviously, when prices are high more sellers consider a transaction as opposed to when the prices are depressed. Over the past six years, pricing has been lower than prior to the credit crisis. It seems unlikely given accounting rules for acquisitions and the related impact on capital that the heady prices realized in the late 1990s will be reached again. There are indications of improvement in pricing, however, as many have reconciled to the new norm.

While the largest concentration of prices is slightly below tangible book value, the total percentage of deals with prices below tangible book values is smaller than in prior years and a strong band of deals with pricing of between 140 percent and 150 percent of tangible book value has emerged. In general, prices have increased from one year ago. Credit quality affects pricing, and because industrywide credit quality has improved, it should come as no surprise that pricing also has improved and that some deals that had been stalled by low pricing are seeing renewed movement.

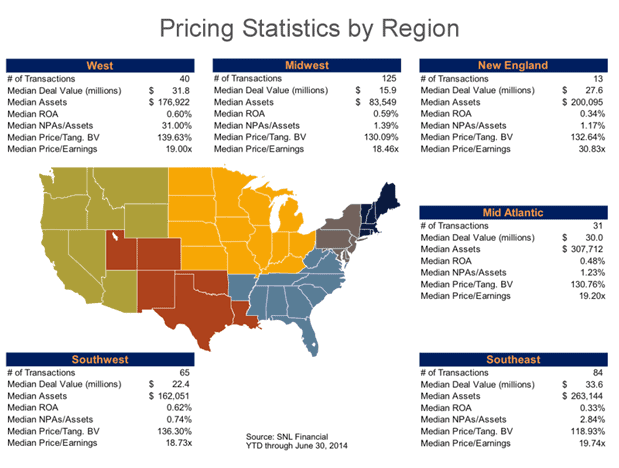

Reviewing deal characteristics by region also shows improved credit quality and improved pricing.

The Midwest experienced the largest number of transactions, but it also includes the largest number of charters. Additionally, the average size of selling banks in the Midwest is the lowest of all regions, which is reflected in the pricing. One region that changed significantly from prior years was the Southeast. Previously, the average return on assets (ROA) of the sellers in that region was negative, and average nonperforming asset levels were very high compared to other regions. This trend has reversed, and for the first time since the credit crisis, the Southeast experienced positive average ROA and improved levels of nonperforming assets. The result is an average price-to-tangible book value in excess of 100 percent. Previously, this ratio was less than 100 percent (from 2012 through June 30, 2013). The West experienced the highest average price-to-tangible book value for the period.

*Note: Median deal values are in millions. Median assets are in thousands.

FDIC Transactions Continue to Decline

The Federal Deposit Insurance Corp. (FDIC) reported that as of March 31, 2014, there were 411 banks on the agency’s Problem Bank List—almost half of the 813 banks included at year-end 2011. As a result, the number of FDIC closures also has declined dramatically, and it appears that about 25 problem banks will be resolved through a sale in an FDIC-assisted transaction. Based on anecdotal experiences, the FDIC has been very patient with a number of the banks it is closely monitoring as many of these institutions have been able to complete recapitalizations or their credit issues have improved enough to be acquired in a non-FDIC-assisted transaction. This trend likely will continue, and the level of available transactions should be modest.

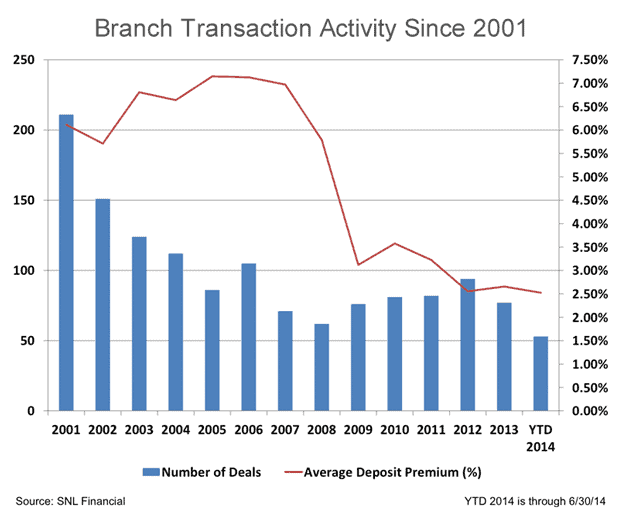

Branch Transactions Continue at Consistent Pace

Branch deal volume has been fairly consistent over the past four years and is on pace to be similar to 2012. Deposit premiums have held fairly steady at approximately 2.5 percent of deposits. For many community banks, small one- or two-branch networks are the only feasible acquisition opportunities. As larger and regional bank holding companies continue to evaluate their branch networks, there likely will continue to be acquisition opportunities available.