Preparing Your Bank to Fight Shareholder Activists

The financial sector has not been immune to the growth in shareholder activism seen in recent years, and certain trends have emerged that make “bank activism” distinct from other parts of the economy. Understanding these trends, the statistics underlying them and their ramifications can help determine the steps banks should take in advance to ensure the best possible outcome should a contentious engagement with an activist ever occur.

The financial sector has not been immune to the growth in shareholder activism seen in recent years, and certain trends have emerged that make “bank activism” distinct from other parts of the economy. Understanding these trends, the statistics underlying them and their ramifications can help determine the steps banks should take in advance to ensure the best possible outcome should a contentious engagement with an activist ever occur.

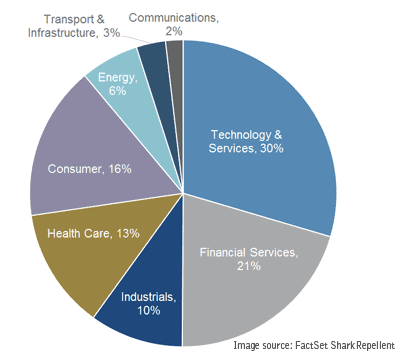

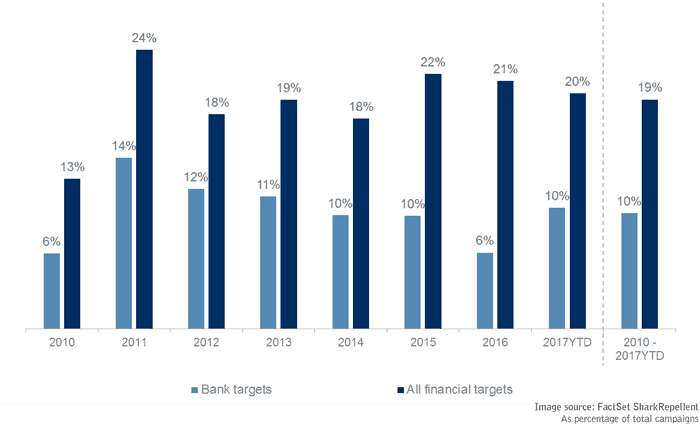

First, financial companies, particularly banks, are among the firms most frequently targeted by activists. In recent years, 21 percent of activist targets have been in the financial sector, second only to technology companies. This focus on the financial services industry has stayed relatively consistent post-financial crisis, with banks comprising the majority of these financial targets, although that may fluctuate some from year to year. Thus, as activism continues to grow, the frequency at which banks are targeted can likely be expected to grow as well.

Campaign Breakdown by Sector, January 16 – July 17

Banks as Percentage of Activist Targets

However, bank targets are significantly smaller than targets in other sectors. Due in part to the complex regulatory regime for banks versus other industries, the main driver for bank activism is to pursue a sale, a strategy usually easier to deploy at smaller companies due to the larger universe of viable buyers. Therefore, banks targeted by activists from January 2016 through July 2017 had a mean market capitalization that was 47 percent smaller than nonbank targets over the same period.

Smaller banks may have fewer resources to respond to an activist. For example, their finance, legal and IR/PR functions may be managed by just a handful of employees, meaning the time and attention required of staff, management and the board can be much bigger. In that case, distraction from the day-to-day duties of running the business can be disproportionately larger.

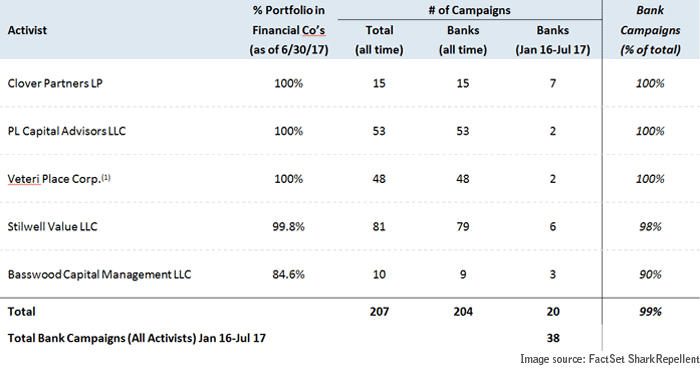

While activists outside of the banking sector are usually industry generalists, bank activists are normally sector-specialist investors. The majority of bank campaigns are currently undertaken by a few hedge funds that invest nearly all of their portfolios in financial companies—primarily banks—and practically all of their previous campaigns have been against banks.

Prominent Activist Investors in Banks

Therefore, these activists have extensive knowledge of the industry, the individual banks and their management teams, and most importantly the decision-makers at other institutional investors that invest in this sector. They also have a successful track record of forcing bank targets to initiate a sale, a marked difference from other sectors where an activist typically is a relatively new fund with little activism or proxy fight experience.

A bank activist may have a generally benign relationship with management and the board, and be a significant shareholder of a small-cap bank for quite some time before agitating. However, when market conditions evolve to support a possible sale, the dynamic can change quite dramatically, potentially leading to transformative change—for better or worse—within a short time. For example, Basswood Capital had been a key shareholder at Astoria Financial Corp. for more than 15 years before filing its 13D and demanding a sale of the company. Astoria capitulated just a few months later, and its acquisition by Sterling Bancorp is expected to close in the fourth quarter 2017.

These factors underscore how bank activists are both experienced and sophisticated, while their targets may be relatively less prepared to effectively respond and, if need be, protect the long-term interests of their shareholders in a public battle. As a result, bank activists are more successful than activists in other sectors at winning board seats, where they can aggressively push forward their agenda. From January 2016 through July 2017, activists were successful in getting board representation at bank targets 32 percent of the time, versus only 26 percent in other sectors.

In this environment, mid- and small-cap banks must be proactive in preparing for, and hopefully avoiding, a confrontation with an activist. First, banks must periodically assess their strategy versus alternatives an activist may demand, and effectively articulate and execute on that strategy. Although not a guarantee, the strongest defense is performance, knowing where you may be vulnerable to criticism by an activist and preemptively trying to mitigate that. Second, banks should develop an activism response plan and team, including members of management and the board, and a ‘go-to’ team of outside advisors with experience in bank activism. Finally, banks should regularly seek feedback from their shareholder constituencies, and be aware of their views on certain issues and how to resolve them. Given how suddenly an activist situation can occur, it is critical to be ready in advance.