Video Banking: Folly or Foresight?

The past several years have not been kind to the retail banking business model. Low net interest margin, depressed lending demand, significantly eroded fee income and higher compliance costs have all contributed. Moreover, steady migration of branch transactions to self-service channels has been eroding branch foot traffic. The result is typically higher branch transaction costs and declining sales results. What is a bank to do?

The past several years have not been kind to the retail banking business model. Low net interest margin, depressed lending demand, significantly eroded fee income and higher compliance costs have all contributed. Moreover, steady migration of branch transactions to self-service channels has been eroding branch foot traffic. The result is typically higher branch transaction costs and declining sales results. What is a bank to do?

The “Branch of the Future” May be Emerging

While substantive branch transformation remains a rarity in North America, there appears to be a growing consensus that the status quo is unsustainable. Celent couldn’t agree more! To understand the state and likely evolution of North American retail banking, Celent fielded surveys in July 2010 and again in July 2012. In 2012, considerably more institutions indicate intentions to make modest to sweeping changes in branch configuration.

Institutions appear to be eyeing a variety of approaches. Some (55 percent in the 2012 sample, up from 24 percent in 2010) see enterprise wide branch design changes likely. An equivalent percentage (57 percent, up from 48 percent) see ultra-low-cost designs in the mix. These small, highly automated outlets may replace some existing branches, while others may be built instead of more expensive traditional designs in new markets. A common objective in contemplating redesign supports a sales/service rather than transactional model (66 percent up from 58 percent).

Source: Celent survey of NA FIs, July 2012, n=132

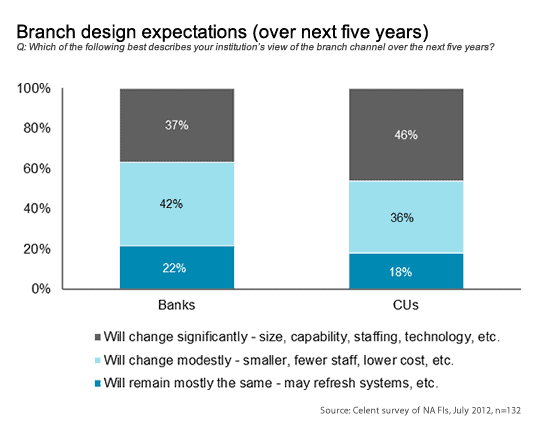

None of this is going to be easy, and banks are wisely being cautious about what to do and how to do it. What has changed over the past two years, however, is the growing number of banks contemplating branch channel initiatives. In the July 2012 survey, more than a third of banks and nearly half of credit unions surveyed expect significant changes in size, capacity, technology and staffing over the next five years. About a third expected more modest changes, and only about one in five surveyed financial institutions expect their branch networks to remain mostly the same over the next five years. We are witnessing a tipping point.

Most branch transformation initiatives seek to achieve the dual objectives of cost reduction and improved sales effectiveness. But, branch transformation, whether modest or significant, doesn’t itself suggest the use of video. Is video banking going to be a good idea? Celent is bullish on the use of personal video conferencing in banking applications. But before defending this assertion, let’s first look at the variety of ways video can be used to accomplish these two objectives.

Video Tellers. Video is being used at drive-through locations and in branch lobbies and vestibules alongside transaction automation technology to provide a low-cost alternative to the traditional teller experience. Credit unions have taken the lead in the use of video tellers both as a replacement of traditional teller roles and as a way to augment traditional teller arrangements. Some financial institutions have used video kiosks (a.k.a., personal teller machines, or PTMs) in de novo branch designs while employing live branch personnel inside the branch to engage customers with needs that go beyond simple transactions.

Video SMEs. In contrast to using video to support routine (teller) transactions, some banks and credit unions are using desktop video conferencing applications to connect customers with subject matter experts (SMEs) such as lending officers and specialized customer support personnel. Consumers could also be connected to SMEs via desktop videoconferencing as part of an online banking experience. Thus far, the prevalent use of video SMEs has been among smaller and rural branches as a way to provide cost-effective service delivery.

The business case for video banking has been demonstrated in many financial institutions, while in others, those still piloting, the jury has not rendered a verdict. Those with successful implementations have seen benefits that may surprise you.

- Cost savings. Coastal Federal Credit Union centralized all its tellers and deployed 63 PTMs across its network. Coastal replaced 74 branch tellers and supervisors with 44 tellers, supervisors, and service staff to support its 15 branches, resulting in a cost reduction of 41 percent while expanding branch hours by 86 percent.

- Improved customer convenience. Multiple PTM implementations are being accompanied by expanded branch hours. Video SMEs can offer expanded offers and shorter (or no) wait times by connecting to an available SME regardless of physical location.

- Improved sales results. Celent has interviewed multiple financial institutions asserting improved sales results through the use of video banking. In most cases, this occurs through automation—largely removing teller transaction processing and reconciliation activity from the branch environment. Remaining branch staff, freed from the administrative burden, can now be devoted to sales and service. With remaining branch staff more focused on sales and service at Coastal FCU, average sales per full time equivalent (employee) per day increased to 2.4, up 49 percent from 1.6 sales per FTE per day when each branch had tellers.

But, will customers accept video banking? Done well, customer response has been strong, with measurable improvements in customer satisfaction. Customer response appears to be strongest when video banking is introduced alongside meaningful benefits such as expanded branch hours or shorter drive-through wait times.

A few short years ago, this would likely have not been the case. Technology improvements have made video conferencing both affordable and more satisfying. The growth of Apple’s Face Time and Microsoft’s Skype bear testimony. But, just as Skype is not for everyone, video banking isn’t either. Celent expects the topic to remain controversial for years to come. In the meantime however, savvy banks will give the idea careful consideration.

Originally published on December 3, 2012.