Online banking is missing something: personal financial management

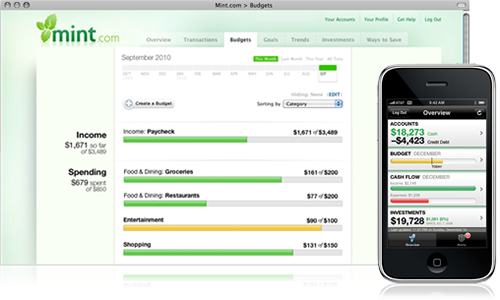

Online banking has stagnated for far too long, so that banks have been left in the dust while innovative non-banks developed state-of-the-art financial tools, such Mint.com, which lets users manage their personal finances and budgeting online. This is according to Jacob Jegher, senior analyst at consulting firm Celent, a division of Oliver Wyman, Inc., who would like to nudge bankers into the current century.

The online banking platform looks like it was built in 1998. That’s because in large part, it was.

“The banks have placed little emphasis on this highly important area while the rest of the world catapults to these very rich and interactive platforms,’’ he says.

Jegher admits there are justifiable reasons banks haven’t been investing a huge amount on new technology. Can anyone say: “Financial crisis?”

Still, he predicts that personal financial management tools will become the cornerstone of online banking, although it will take three to five years, which he writes about in his May report, “Top Trends in Retail Online Banking.”

The reason is simple: Customers frequently cite the need for help with financial planning and saving. Also, information about an individual’s spending habits is an enormous treasure trove that every chief marketing officer would like to get his or her hands on.

The bank could use that data to offer the right pitches at the right time, say when the bank knows it can offer customers a lower interest on a mortgage, if their current mortgages are with a competing bank.

The idea that companies use personal, private financial information to market products may not appeal to many consumers, but it’s been going on for a long time. Targeted online advertising has been helped along by companies such as Facebook. (People who write in their Facebook profiles that they’re single get advertisements from dating web sites when they log on).

Some banks have begun using Intuit’s FinanceWorks as a personal financial management tool in their websites, it but looks completely different and “disconnected” from the rest of the bank’s online platform, Jegher said. (Celent doesn’t sell any technology tools itself).

Jegher is pushing for banks to revamp their entire online platforms to incorporate personal financial management tools into a seamless experience with the rest of online banking, including bill pay. Some already are in the planning stages to do just that.

Bill pay could be improved as a way to capture more transaction volume, and therefore revenue, while making relationships with customers more permanent. Nowadays, bill pay technology is typically just patched onto the legacy online banking platform and is offered by only a handful of software providers, according to Jegher.

Celent says banks handle about 25 percent of total bill pay transaction volume through online bill pay (the vast majority of the rest is checks or customers paying directly to their credit cards and other service providers).

Not everyone is going to agree that personal financial management must be the cornerstone of any online banking platform. But it’s certainly an interesting approach. Banks already are the fulcrum of their customers’ financial lives. It will be interesting to find out what they do with that in the next few years.