Sarah Martin is CEO of Pulsate, a provider of mobile-first, personalized member engagement solutions enabling customers to optimize revenue and engagement through their digital channels with data-driven, personalized, localized and relevant mobile marketing communications.

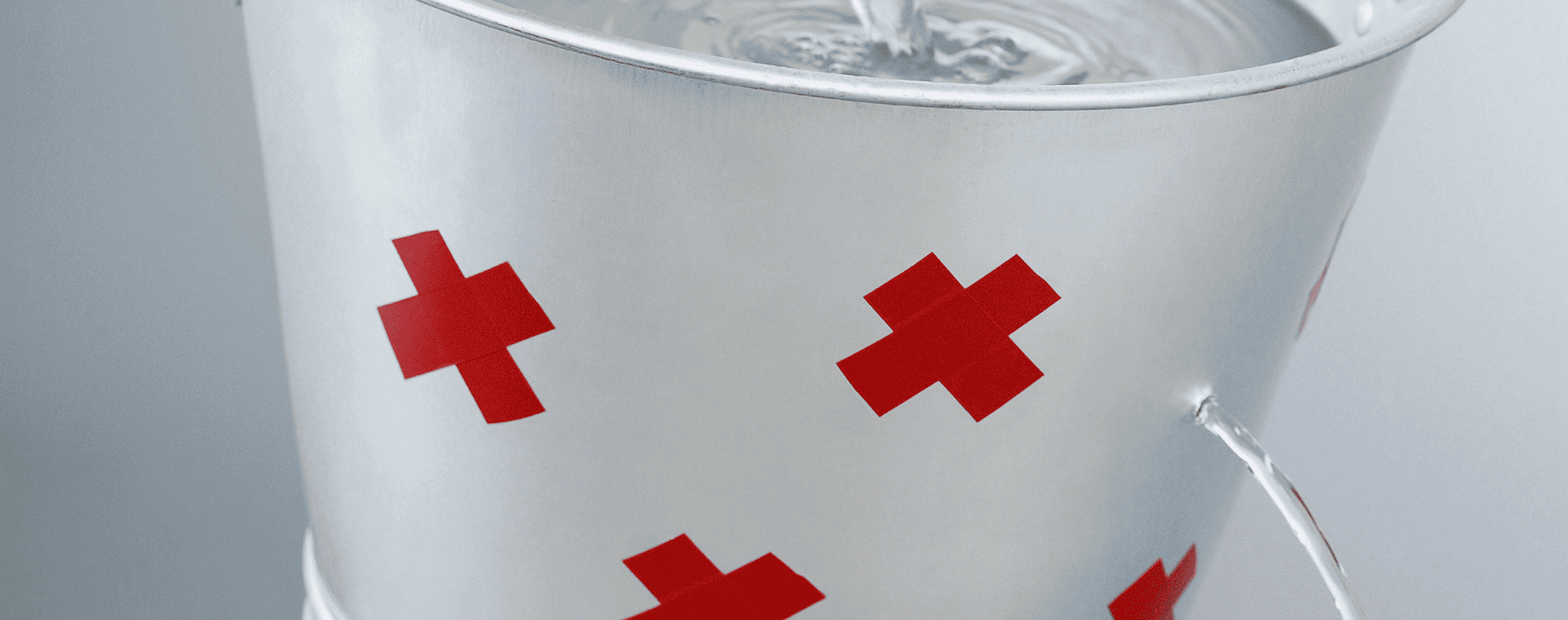

Patching Your Leaky Bucket: How Banks Can Address Silent Churn

Banks that leverage personalization and digital channels to promote deeper engagements can boost customer retention and transform passive relationships into active, revenue-generating ones.

Brought to you by Pulsate

All banks want more customers. It is a universal, almost axiomatic, truth.

While the logic that more accounts should translate to more revenue seems simple enough, acquiring those customers is not always easy or cheap. In fact, the average cost of adding a new customer for a bank is $784. With the average customer only contributing around $300 annually to an institution’s overall revenue, this investment can take years to recoup, even with the best strategies.

Additionally, there is a pervasive, fundamental problem lurking insidiously beneath the surface and continuously poking holes in many traditional growth strategies: silent churn.

The Silent Churn Challenge: Why Banks Are Losing Customers

Silent churn, where customers disengage without formally closing accounts, poses an inconspicuous yet substantial threat for today’s banks. Industry data suggests that anywhere from 15% to 25% of customers leave their financial service providers annually. Attrition rates can be three times that high for accounts open less than six months. Who is to say what those figures would look like if every dormant account were factored into the equation?

Couple this hidden retention problem with rising customer acquisition costs, and conventional growth strategies quickly become unsustainable — like putting water in a leaky bucket. But to address the issue, banks must first understand its origin and why so many banking customers can suddenly become so fickle.

Simply put, consumers expect more, especially from the digital channel. And they have the leverage to do so. Accessibility, ease of use, holistic oversight, robust features and integration all combine to catalyze the steady migration to digital banking. Now, in today’s fast-paced, evolving banking landscape, if an institution’s platform falls short, it is easier than ever to look elsewhere.

To combat silent churn, banks can align with modern customer expectations and pivot toward retaining the relationships they have worked so hard (and spent so much on) building. Even a minor strategic and budgetary shift from acquisition to retention can help patch this leaky bucket.

A Strategic Shift: Embracing Mobile First Engagement for Retention

Most meaningful banking interactions today occur online or via mobile phones instead of in physical branches. Rather than relying on a friendly smile and cheery in-person disposition, banks are finding they must now tailor their services and communications to their customers in a virtual format.

To effectively engage customers, financial institutions can start with personalization. Real world or virtual, people still want experiences that cater to their needs; however, many banks still tend to struggle in this area. According to recent data, just 14% of banking customers rate their providers as extremely effective at delivering tailored experiences and product offers, and 50% of those customers expect banks to be more proactive about sharing relevant financial information and advice.

There is a clear and present opportunity for banks to do so through mobile engagement. Digital communication tools that are built around customer interactions — such as push notifications, in-app messaging and geolocation services — can be combined into concierge-style services that resonate with individual needs and preferences, sharing relevant information and offers with customers, in their times of need.

A triggered push notification can prompt both new and dormant users to activate their accounts. A timely reminder about an account balance can save a customer from an accidental overdraft. A personalized loan offer based on direct customer behavior can transform a routine banking activity into a valuable engagement for both the individual and the bank.

Banks that leverage technology to deliver personalized, timely and relevant communications can enhance customer satisfaction, strengthen loyalty and create and nurture additional revenue generating opportunities.

Customer Acquisition and Retention: A Delicate but Necessary Balance

By concentrating predominantly on acquisition, today’s banks risk neglecting their existing customer base, accelerating silent churn. Integrating strategic communications into the customer journey, especially via mobile and digital channels, can help banks transform passive account holders into active, engaged, multi-product, revenue-contributing customers.

The bottom line is acquisition and retention are each integral components for sustainable growth — the former drives market share, while the latter drives customer lifetime value — so banks should prioritize both to keep their buckets intact and their businesses growing.