What’s Driving Interest in Bank Primacy?

Brought to you by PrecisionLender

Becoming a valued client’s primary commercial bank – or primacy u2013u2013 has been a hot topic during our daily conversations with bankers. At some point during those discussions, how to define and achieve primacy is bound to come up.

But primacy is not a brand-new concept. So why has it vaulted in recent months to the top of the to-do list at many commercial banks? We dug into the PrecisionLender pricing database to look for potential explanations.

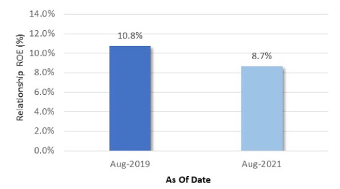

The lending environment since the start of the pandemic in 2020 has not been a friendly one for bankers that build relationships purely around credit. Thanks to decreases in rates that weren’t always accompanied by similar declines in funding costs, the return on equity for credit-only relationships has declined more than 200 basis points in the past 24 months.

Cohort Group of Credit-Only Relationships

Profitability Trends

At the same time, deposits aren’t helping banks. In the previous market cycles, deposits were extremely attractive: They were a way to maintain, or even improve, spreads by lower funding costs. But right now, deposit costs aren’t really much lower than other wholesale funding options. Even though these relationships have experienced significant deposit growth in the past two years, that’s only been enough for banks to tread water when it comes to return on equity.

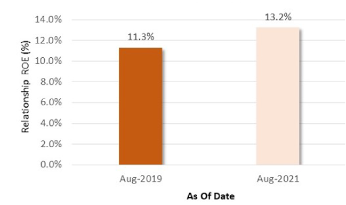

We then looked at a third group of commercial relationships. This group started off as credit only, but expanded to include both deposits and ancillary fee-based business. This group is the type of primary relationship that banks are now focused on winning: clients who keep a substantial portion, if not all, of their accounts with the same institution. The return on equity payoff is handsome – an average increase of about 190 basis points over the past two years.

Cohort Group of Relationships – Cross-Sell Growth

Profitability Trends

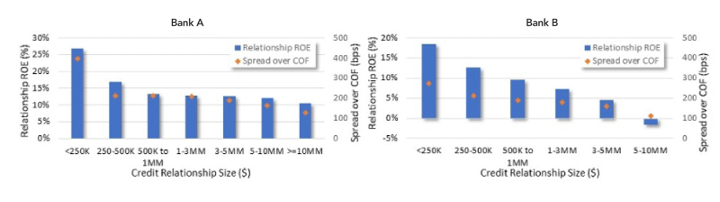

Bankers will often argue there are situations where it’s worth it to book a credit-only deal. We looked a variety of banks, from a wide range of geographies and asset sizes, and found that to be true – but only in a very select set of situations.

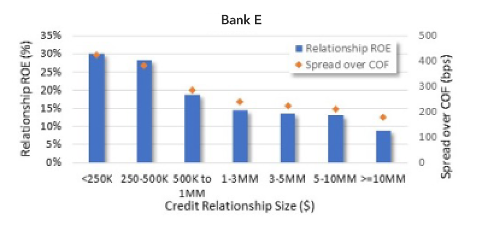

Credit-Only Accounts: Spread Over COF vs. ROE by Size

Depending on the bank’s targets for return on equity, small business loans can be profitable even without cross-selling other products or reservices. But as loan sizes rise and margins narrow, the return on credit-only relationships drops markedly. In some cases, such as Bank B, bankers may end up booking large loans that actually have a negative return on equity. But perhaps that relationship is only meant to stay credit-only for a brief time. Even if the return isn’t great initially, it can be worth it to land the initial, credit-only relationship with the hopes of expanding later, right?

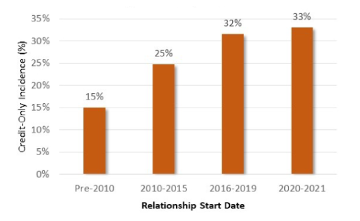

In theory, yes. In reality, credit-only is not a temporary status for a considerable number of commercial relationships. Winning ancillary business takes time; sometimes it never happens. Nearly a third of credit-only relationships started between 2016 and 2019 have yet to add any non-credit accounts. We found 15% of relationships started more than 10 years were still credit-only today.

Credit-Only Incidence as of August 2021

By Relationship Start Date

In previous research, we’ve found that banks have historically failed to reprice credits over time, even when anticipated cross-selling opportunities did not materialize. This left the portfolio with underperforming relationships that dragged down performance for years.

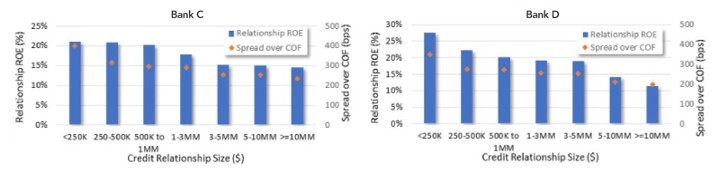

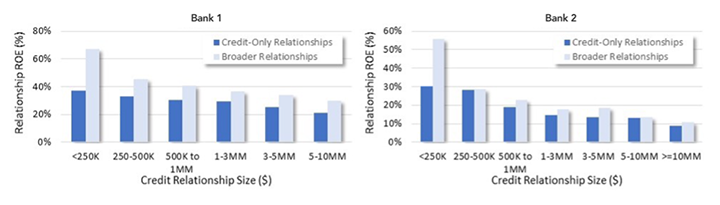

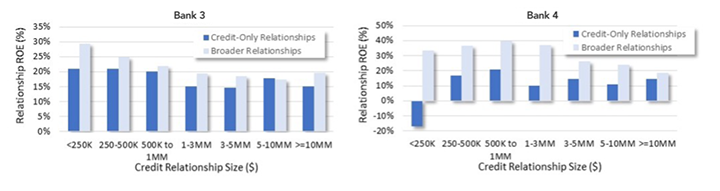

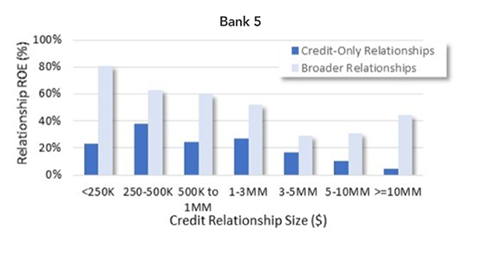

The case for credit-only relationships gets even weaker when compared to broader relationships that encompass credits, deposits and fee-based services. Obviously, bankers know “broader is better,” but they not have realized just how much better these relationships are for the portfolio.

Credit-Only vs. Broader Relationships

Relationship ROE by Size of Credit Relationship

Taken together, this data explains why primacy is the topic du jour at many commercial banks. Simply lending your way past the stress that 2020 put on your bank’s portfolio isn’t an option; it can actually be a game of diminishing returns that could drag on for years. Adding deposits – something banks have had no trouble doing over the past two years – may only be enough to keep your bank running in place. To make a significant impact on the bottom line, your bank needs to achieve primacy through broader relationships with your most-valued clients. That’s why everyone’s talking about primacy now. But the smart banks are doing more than just talking; they’re adding processes and investing in technology to make primacy a reality.