AMERIBOR Benchmark Offers Options for Bank Capital Raises

Brought to you by The American Financial Exchange

Banks that belong to the American Financial Exchange (AFX) are not waiting until 2021 to make the switch away from the troubled London Interbank Offered Rate, or LIBOR, interest rate benchmark for pricing their offerings in the capital markets.

These institutions, which represent $3 trillion in assets and more than 20% of the U.S. banking sector, are using AMERIBORu00ae to price debt offerings now. They say AMERIBORu00ae, an unsecured benchmark, better reflects the cost of funds as represented by real transactions in a centralized, regulated and transparent marketplace. The benchmark has been used to price loans, deposits, futures and now debt – a critical step in a new benchmark’s development and financial innovation.

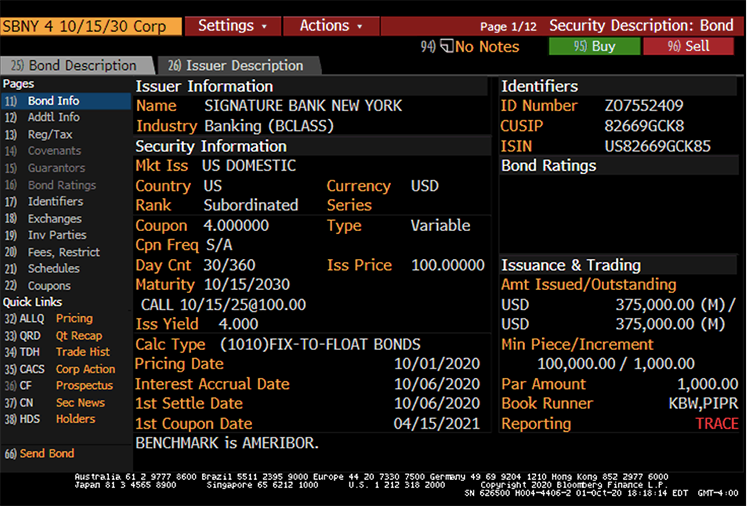

In October, New York-based Signature Bank announced the closing of $375 million aggregate principal amount of fixed-to-floating rate subordinated notes due in 2030 – the first use of AMERIBORu00ae in a debt deal. The notes will bear interest at 4% per annum, payable semi-annually. For the floating component, interest on the notes will accrue at three-month AMERIBORu00ae plus 389 basis points. The offering was handled by Keefe Bruyette & Woods and Piper Sandler. The transaction was finalized the first week of October 2020.

Signature Bank Chairman Scott Shay highlighted the $63 billion bank’s involvement as a “founder and supporter” of AFX.

“We are pleased to be the first institution to use AMERIBORu00ae on a debt issuance. … AMERIBOR is transparent, self-regulated and transaction-based, and we believe that it is already a suitable alternative as banks and other financial institutions transition away from LIBOR,” Shay said.

The inaugural incorporation of AMERIBORu00ae in a debt offering paves the way for more debt deals and other types of financial products linked to the benchmark. The issuance adds to the list of U.S. banks that have already pegged new loans to the rate, including Birmingham, Alabama-based ServicFirst Bancshares, Boston-based Brookline Bancorp and San Antonio-based Cullen/Frost Bankers. As AFX adds to deposits, loans and fixed income linked to AMERIBOR, the next risk transfer instrument up for issuance will be a swap deal.

Banks of all sizes have options to choose from when it comes to an interest rate benchmark best suited to their specific requirements. AMERIBORu00ae was developed for member banks and others that borrow and lend on an unsecured basis. Currently, AFX membership across the U.S. includes 162 banks, 1,000 correspondent banks and 43 non-banks, including insurance companies, broker-dealers, private equity firms, hedge funds, futures commission merchants and asset managers.

This article does not constitute an offer to sell or a solicitation of an offer to buy the notes, nor shall there be any offer, solicitation or sale of any notes in any jurisdiction in which such offer, solicitation or sale would be unlawful.