A Banker’s Perspective on LIBOR Transition to SOFR

Brought to you by Abelian Partners

The scandal associated with manipulation of the London Interbank Offered Rate (LIBOR) during the 2008 financial crisis caused a great deal of concern among banking and accounting regulators. In 2014, the Financial Stability Oversight Council recommended that U.S. regulators identify an alternative benchmark rate to LIBOR. This recommendation was given an effective timeline in 2017 when the UK Financial Conduct Authority, as the regulator of LIBOR, announced the intent to discontinue the rate by year-end 2021. The Federal Reserve and the Alternative Reference Rates Committee (AARC) have since recommended the Secured Overnight Funding Rate (SOFR) as the recommended replacement rate for LIBOR. Additionally, the AARC recommends that all LIBOR loan agreements cease using any LIBOR index rates by Sept. 30, 2021.

The transition to SOFR presents two distinct challenges for U.S. banks: term structure and fallback language.

Term structure: SOFR is an overnight rate, and not directly appropriate for term lending with monthly or quarterly resets. As such, several possibilities for using SOFR for term lending have emerged, with the main recommendation being Daily Simple SOFR plus a spread adjustment. This spread adjustment is currently 12 basis points for 1-month LIBOR and 26 basis points for 3-month LIBOR, reflecting the difference between SOFR as a secured rate and LIBOR as an unsecured rate. More importantly, Daily Simple SOFR is an arrears calculation, which is not particularly client-friendly for a standard commercial bank loan. Nevertheless, the AARC recommends that Daily Simple SOFR be used to replace LIBOR until a true term SOFR rate emerges.

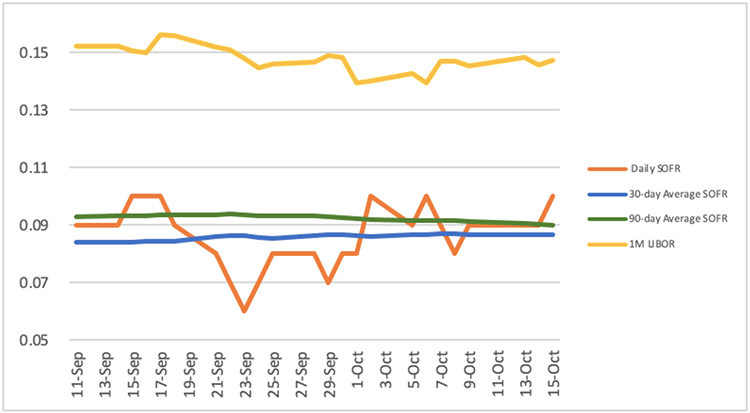

SOFR vs 1-month LIBOR

Source: Federal Reserve Bank of New York

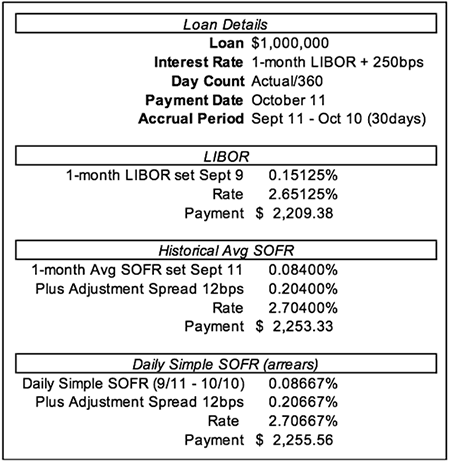

Banks are continuing to discuss options that would be easier for clients to understand on smaller bilateral loans, including prime or a historical average SOFR set at the beginning of an interest period (Figure 1). While not necessarily in-line with the cost-of-funds approximation of Daily Simple SOFR in arrears, the ability to set a rate at the beginning of an accrual period may be more appealing for client-friendly relationship banking. Overall, the market still needs to settle on the best SOFR rate solutions for bilateral bank loans, and banks need to have a plan for using overnight SOFR until a true term SOFR rate is available.

Figure 1: Calculation Options for monthly payment

Fallback language: Most existing loan documentation is not expected to support SOFR without amendment. The AARC recommends adding “fallback language” to existing loan documents, with a very specific “hardwired” approach to using SOFR. This language defines a “waterfall” of options, depending upon what SOFR rates are available. However, many banks have also been working through a more general fallback language, to allow greater flexibility for different types of SOFR calculations as well as the use of other replacement rates. Whatever language is used, however, commercial banks are likely to have hundreds of thousands of floating-rate LIBOR loans that will need to be amended with new fallback language within the next 10 months.

In light of these issues, banks need to examine three key areas that will be affected by LIBOR replacement: documentation, systems and analytics.

Documentation: All existing LIBOR-based loans will need to be reviewed and potentially amended with appropriate fallback language before September 2021. Amendments will require consent and signature from clients, opening the opportunity for negotiation of existing terms. Banks should have appropriate legal and banker teams working the review and amendment negotiation process with clients. And plenty of time should be allocated for these amendments to be executed and booked ahead of the fourth-quarter 2021 discontinuation of LIBOR.

Systems: All loan and trading systems that index to LIBOR will need to be re-coded to support SOFR. Most major loan system vendors have already created updates to support multiple SOFR calculations, which banks will need to install and test before re-booking amended LIBOR loans. Interfaces and downstream systems may also be impacted. Overall, a full enterprise examination of systems is required as loan systems are re-coded for the SOFR rate.

Analytics: All models – including those used for funds transfer pricing, risk adjusted return on capital and asset-liability management – will need to be rebuilt and pushed into production to support a new SOFR base rate. Aligning the new floating rate index of SOFR with the models used internally to price funds and risk is essential to ensure that lending is evaluated appropriately.

The move from LIBOR to SOFR is now less than a year away. Bankers have generally embraced an approach to using SOFR; however, there is a great deal of work to be done on documentation, systems and models to be ready for the conversion in 2021.