Do Independent Chairs Reduce CEO Pay?

In an advisory vote earlier this year, shareholders roundly rejected JPMorgan Chase & Co.’s executive compensation package, particularly a whopping $52.6 million stock option award for CEO and Chair Jamie Dimon. But at the same time, shareholders voted against a proposal to split those roles.

The proxy advisory firms Glass Lewis and Institutional Shareholder Services favor separating the CEO and chair roles. “Executives should report to the board regarding their performance in achieving goals set by the board,” Glass Lewis explains in its 2022 voting guidelines. “This is needlessly complicated when a CEO chairs the board, since a CEO/chair presumably will have a significant influence over the board.”

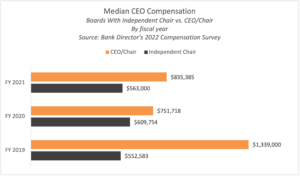

An analysis of Bank Director’s Compensation Survey data, examining fiscal year 2019 through 2021, finds that CEOs earn less when their board has an independent chair. Most recently, the 2022 Compensation Survey, sponsored by Newcleus Compensation Advisors, found that banks with separate CEO and chair roles reported median total CEO compensation of $563,000, compared to $835,385 where the role was combined.

The results are striking, but they should be taken with a grain of salt. The information collected from the survey, which is anonymous, doesn’t include factors like bank performance. Respondents skewed toward banks with an independent chair. And data alone can’t sufficiently describe what actually occurs in corporate boardrooms.

“I can’t really say which model works better. Look at Jamie Dimon; that’s worked really well for the shareholders of JPMorgan Chase, whereas I think there have been three or four initiatives to try to split that role,” says Jim McAlpin Jr., a partner at the law firm Bryan Cave Leighton Paisner. McAlpin also serves on the board of Bank Director’s parent company, DirectorCorps. “It was voted down every time by the shareholders.”

CEOs typically negotiate when and whether they’ll eventually be named chair when they join a bank, says McAlpin. “If you have a very impactful, strong CEO who wants to be chair – most boards will not deny him or her that position, because they want [that person] running the bank.” It’s a small price to pay, he adds, for someone who has such a dramatic influence on the bank’s performance. “There is nothing more important to the bank than a CEO who has a clear vision, who can show leadership, form a good team and can execute well,” says McAlpin.

But it’s important to remember that boards represent the interests of the shareholders. “The most important thing a board has to do is hire and retain a quality CEO. Part of retaining is getting the compensation right,” says McAlpin. “It’s important for the board to control that process.”

McAlpin favors appointing a lead director when the CEO also has the chair position, to provide input on the agenda and contribute to the compensation process.

Truist Financial Corp., in response to shareholder pressure around chair independence in 2020, “strengthened” its lead independent director position, according to its 2022 proxy statement. Former Piedmont Natural Gas Co. CEO Thomas Skains has served as lead independent director of the Charlotte, North Carolina-based bank since March 2022. Skains has the authority to convene and set the agenda for executive sessions and other meetings where the chair isn’t present; provide input on the agenda, and approve board materials and schedules; and serve as a liaison between the independent directors and CEO and Chair William Rogers Jr.

But one individual can’t single-handedly strengthen the board, says Todd Leone, a partner and global head of executive compensation at McLagan. The compensation committee is responsible for the company’s pay programs, including executive compensation, peer benchmarking, reviewing and approving executive compensation levels, recommending director compensation, evaluating the CEO’s performance and determining the CEO’s compensation. With that in mind, Leone says the strength of the compensation committee – and the strength of its committee chair – will influence the independence of these decisions.

Leone also believes that increased diversity in the boardroom over the years has had a positive effect on these deliberations. “A diverse board, in my experience, they’re asking more questions,” he says. “And through that process of asking those questions, various things get unearthed, and the end result generally is stronger pay programs.”

Twelve years of Say-on-Pay – where public company shareholders offer an advisory vote on the top executives’ compensation – has also benefited those decisions, he says. Today, most long-term incentive plans are based on a selection of metrics, such as return on assets, income growth, asset quality and return on equity, according to Bank Director’s 2022 Compensation Survey. And in August, the U.S. Securities and Exchange Commission passed a pay versus performance disclosure rule that goes into effect for public companies in the fiscal year following Dec. 16, 2022.

“There’s a much higher bar for getting these plans approved,” says Leone, “because the compensation committees feel much more responsibility for their role in that process.”

In McAlpin’s experience, the best CEOs have confidence in their own performance and trust the process that occurs in the boardroom. “If they don’t like the results, they’ll give feedback, but they let the process unfold,” he says. “They don’t try to overtly influence the process.”

Heading into 2023, Leone notes the whipsaw effects that have occurred over the past few years, due to the pandemic, strong profitability in the banking sector and looming economic uncertainty. These events have had abnormal effects on compensation data and the lens through which boards may view performance. “We’re in a very volatile time, and we have been on pay since the pandemic,” says Leone. “Boards, [compensation] committees and executive management have to be aware of that.”