Closing the Disability Insurance Compensation Gap

Brought to you by NFP

Many highly compensated employees are unaware of the financial impact it would have if they were to become sick, disabled or unable to work.

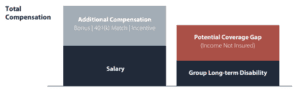

How many of your bank’s executives would have to spend their retirement assets, personal savings or monetary reserves if they lost their income due to an illness or injury? They may currently have a group long-term disability plan, but those plans don’t cover an earner’s full salary, which can include bonus, commissions and 401(k) income, leaving a coverage gap. These plans often leave your company’s highest earners vulnerable to the gap, with only 30% to 50% of their income protected, while most of your broad-based employees achieve more significant income protection.

While the business disruption of losing one of your top-tier workers to injury or illness is difficult enough on its own, standard disability insurance creates a compensation gap for the institution’s, undermining the welfare of your business and leaving affected executives out in the cold. Coverage caps on the maximum benefit allowed affects highly compensated employees, which causes them to have less income protected than rank-and-file employees; the higher the income, the lower the income replacement percentage.

Group long-term disability coverage is a common benefit companies provide to the employees. This coverage is designed to provide a basic level of coverage at the lowest possible cost. Group contracts are temporary agreements, typically written with 2 to 3 year rate and contract language guarantees.

A $1.3 billion bank recently implemented a supplemental disability plan after uncovering a problem with their current nonqualified plan. There was a risk of not receiving the deferred compensation plan benefits if an employee became disabled, as well as not receiving anything close to 60% of their current salary if they were to become disabled. The problem grew each year, due to the rising costs of salaries, bonuses and impressive growth of the bank.

Under the current plan, the participants were to receive 67% of their base and bonus, to a maximum benefit of $10,000 a month. However, for some of the bank’s most highly valued and compensated participants in the plan, that maximum benefit is significantly less than 67% of their total income. But by adding a supplemental individual disability offering to the existing group LTD benefit, they can increase an employee’s level of protection up to 75% of base and bonus compensation.

So, what are the benefits? For the bank, there are packaged pricing discounts available with many group LTD carriers when they add individual disability insurance. Competitive bidding is high with group LTD carriers when the maximum benefit isn’t increased; the LTD rate volatility is reduced when risk is spread among a combination of group LTD and individual DI.

There are also several benefits for employees. For starters, it can provide maximum income replacement ratios. Individual DI rates are permanent to age 67 and can be offered as guaranteed standard issue, meaning medical exams aren’t required. The contracts and discounted rates are portable if the employee leaves. Plans can include an additional catastrophic benefit and cover all forms of compensation including equity. Finally, the plans can give employees the ability to purchase additional coverage, up to 75% of total compensation.

Minimizing Expenses, Maximizing Coverage

So, how can your institution minimize the expense and offer the best coverage? Individual disability benefits increase overall plan maximums, protect bonuses and allow for tax-free benefits – all benefits that allow highly compensated employees to raise their income replacement to necessary levels. Banks that combine group LTD with individual DI coverage create a solid, well-thought-out plan that deliver big benefits to top earners while helping keep company costs in check. Adding a supplemental individual disability insurance (IDI) offering to the existing group LTD benefit increases an employee’s level of protection up to 67% of base and bonus compensation.

Much of your bank’s success depends on the talents of key employees. But keeping the people who keep the business going is easier said than done. Higher pay is only one of the answers; providing quality benefits and educating employees on them is another opportunity. Supplementing group long-term disability (LTD) with individual disability income insurance (IDI) can be a vital part of better protecting your employees. It’s easy, and a great way to let them know how valuable they are to you and your bank. Implementing an IDI can help attract and keep the best talent in your industry while helping employees protect one of their greatest assets: their income.