A Framework for Incentive Plan Adjustments

Brought to you by Meridian Compensation Partners

Over the last few years, compensation committees have used their discretion more readily to approve adjustments that impact incentive award payouts. These adjustments were a practical matter during the pandemic and a more recently, to address the rapidly changing interest rate environment. Compensation committees made decisions to achieve appropriate outcomes, given external forces, while holding management accountable for results.

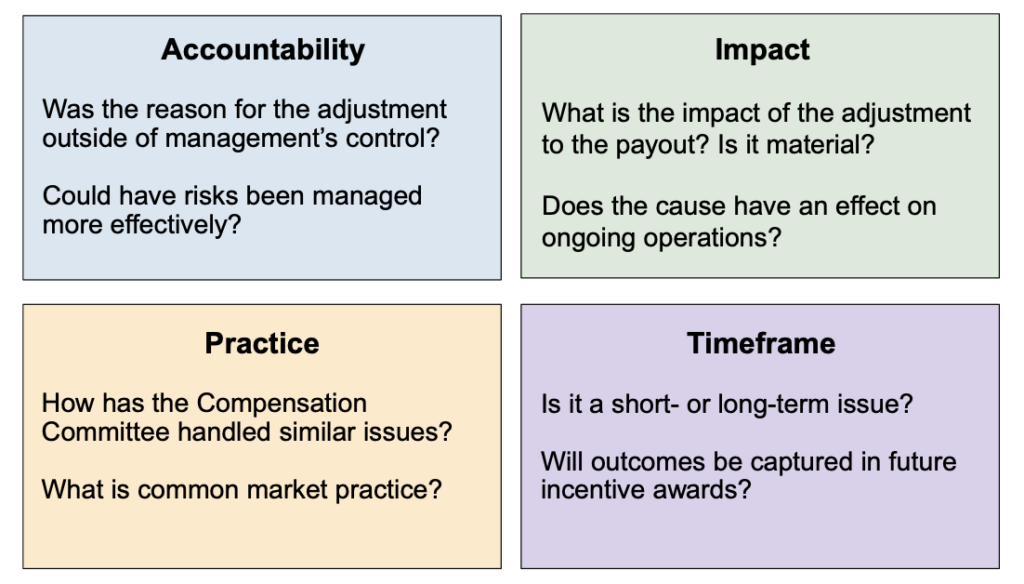

While compensation committees often spend time determining whether adjustments lead to a balanced outcome, they often pay less attention proactively thinking through the process which could be used for future decision making. The following principles create a framework that operationalizes the use of adjustments to metrics from year to year.

Principle 1: Accountability

Compensation committees should determine whether a potential adjustment was due to material external changes or factors that could have been avoided through better decision making. For example, accounting and tax law changes are regularly excluded for the year in which they are enacted and after the goals have been set. Conversely, taking a certain accounting or tax position that ends up being faulty is unlikely to be excluded from actual results, since it was a management decision.

Principle 2: Impact

Any modifications should include documentation from management regarding the impact of the adjustment on the payout and a year-over-year history of adjustments. The document should walk the compensation committee through the issue, the rationale for the adjustment and the financial impact. Assessing the effect to ongoing operations is an important aspect, since adjustments may be made due to a mid-year decision but then incorporated into the banks budgeting process on a go-forward basis.

Compensation committees should discuss potential adjustments at the time business decisions are made, so that it builds in adequate time to review requests. Last-minute requests for adjustments put the compensation committee in the difficult position of understanding incentive outcomes and the rationale for adjustments at a time when agendas are jammed-packed with year-end decisions. The committee’s inclination may be to simply acquiesce and move the meeting along, leaving directors afterwards feeling strong-armed into a point of view.

Principle 3: Bank and Market Practices.

The compensation committee should develop a guideline document that identifies the categories of adjustments it may or may not exclude. For example, events outside of management’s control that could have a material impact to the business, such as tax and regulatory changes and natural disasters, are common adjustments. Certain non-recurring expenses due to mergers and share buybacks may also be excluded in the year in which a business decision is made but was not part of the annual budget. For these events, compensation committees should ascertain whether management’s decisions provided a positive impact to shareholders and the adjustment eliminated a potential disincentive to act in shareholder’s best interests.

There should be documentation summarizing current and historical adjustments the compensation committee could use as a reference to ensure consistency year-over-year. Often adjustment decisions are discussed in executive session, leaving little documentation around the rationale; and the actions become buried in multiple meeting minutes throughout the years. Listing the categories of potential adjustments and the history of past actions will help clarify which adjustments are acceptable while allowing flexibility for unique circumstances.

Principle 4: Timeframe of Adjustment

Compensation committees should assess whether the reason for adjusting is a short- or long-term issue. For example, a one-time management decision that would likely result in better performance over the long-term may reduce an annual incentive payment in the current year, but increase the value of future award payouts, in both the annual and long-term incentive programs.

Developing a framework that evaluates adjustments along with a process for deliberation is likely to result in more confidence in the outcomes, greater consistency in practice and a more efficient process for management and the compensation committee.