From how-to articles, director training videos, key interviews with industry leaders and more, Bank Services provides bank executives and directors with the tools to help grow their financial institutions.rnrnTo sign up for exclusive access to this online bank board resource, please contact Bank Services at 615-777-8461 or [email protected].

Growing through Relationships

Our annual M&A conference, Acquire or Be Acquired was off to a good start this past Sunday in sunny Scottsdale Arizona with close to 700 attendees representing 265 financial institutions from around the country. After an early morning round of interactive workshops, several hundred banking professionals and industry experts gathered in the large Arizona ballroom to hear from two bank CEOs who have had success growing their institutions despite the challenging economy and it’s impact on the financial services industry.

As DeVan Ard, President and CEO of Reliant Bank a $400-million asset institution out of Nashville Tennessee, and Andrew Samuel, Chairman and CEO of Tower Bancorp Inc., a $2.7-billion asset holding company out of Enola, Pennsylvania described their markets, cultures and growth strategies, a pattern began to emerge between the two institutions despite the differences in their location, size and business lines.

Both focused on their strengths

During Ard’s presentation, he encouraged the audience to stay focused on building value to the franchise through bank relationships, rather than becoming solely credit driven. He attributed the success of Reliant Bank on its ability to remain focused on what made it profitable.

Tower Bancorp’s approach was quite similar in that Samuel recommended that his fellow bankers recognize what they do well, know their markets inside and out, and resist the temptation to look at other opportunities that don’t fit your core business model.

Both embraced relationship banking

It was clear that both institutions valued the relationships that they had built with their customers, employees, shareholders and other strategic partners. Reliant Bank was able to grow their post-recession deposits by 5-6 percent by leveraging existing relationships with customers and asking for referrals.

By knowing their market, Tower Bancorp was able to design fee-based products specifically for local not-for-profit groups whose boards were filled with the who’s who of their community, thus providing an intangible value to the bank. As a result, the bank created an advisory board to focus solely on this niche market.

Both overly communicate with everyone, including their regulators

It was certainly a common discussion throughout this year’s conference whether the regulatory challenges would take away from the ability to focus strategically on growth. Ard and Samuel both recognized that this was indeed a challenge, however by being proactive and keeping the lines of communication open with the regulators, they have little chance to be surprised.

In addition, Ard felt it was equally important to over communicate with employees, shareholders, media, and the community. By sharing with the employees the financial position of the institution, Reliant Bank was able to get the employees to buy into the plan to slow down growth as they weathered the economic downturn.

Both always look for acquisitions opportunities

Reliant Bank and Tower Bancorp are always on the lookout for potential acquisition opportunities with each having acquired branches and/or other banks within the past few years, however they never lost sight of growing organically. With over 800 banks still on the troubled list and many bankers simply suffering from fatigue, acquisitions are still a viable growth option for both institutions.

At Tower Bancorp, the acquisition strategy is simple, Samuel is responsible for creating strategic partnerships with larger banks in the area as well as actively calling on banks in the surrounding markets to negotiate potential acquisition deals. By building relationships with these potential future sellers, those banks are more open to working with Tower Bancorp, once their board makes the decision to sell.

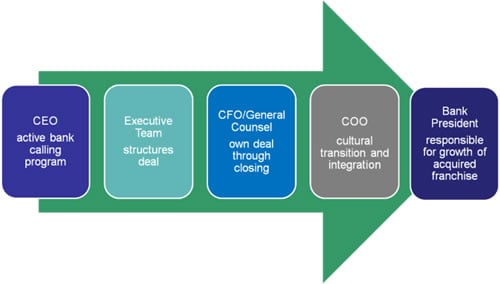

Samuel still believes that Tower Bancorp can achieve a loan growth figure in the double-digits this year but remains steadfastly focused on organic growth. His acquisition process ensures that not every executive member of institution is involved throughout the entire process. By sharing the responsibilities across the board and senior management, the team has less opportunities to neglect their first priority of organic growth.

Both work diligently with their board

Involving the board throughout the entire process is key to both institutions success. At Reliant Bank, their three year strategic planning started with management, who then shared and received feedback from the board which was ultimately executed by the senior management team. Each quarter they meet to review the tactical plan to make sure it’s in alignment with the overall strategy.

Samuel indicated that Tower Bancorp followed a similar approach with a three-year strategic plan that is reviewed nine times a year. The board is always aware and proactively engaged with the executive team.

Two stories of success from two types of banks — one privately-held, one publicly-traded — one in the south, one located in the north, yet both remained focused on what they were good at while leveraging key relationships to ensure the growth of their organizations during the financial crisis.

You have accessed a resource that is only available to our Bank Services members.

Read The Article

Please enter your username and password bellow. If you have established a password please click ‘forgot your password’