Opportunity knocks, but there are drawbacks

The mess in banking isn’t over yet.That means hundreds of banks, most of them small, community organizations, likely will fail in the years to come. The flip side of all that carnage is an opportunity for bankers to buy troubled institutions, grow balance sheets during tough economic times and let the Federal Deposit Insurance Corp. take most of the bad assets of the failed bank.

The investment bankers and attorneys who attended Bank Director’s May 2nd conference in Chicago agreed on one theme: There are still plenty of deals to be had for banks looking to buy failed institutions from the FDIC, as long as they work hard, fast and smart to do the deals right.

“There is ample opportunity,’’ said Jeffrey Brand, managing director at investment bank Keefe, Bruyette & Woods. “The FDIC will allow you to bid as many times as you like and they will let you be as creative as you like.”

There were more than 523 banks with $318.3 billion in assets at the end of last year that had Texas ratios topping 100 percent, said Brand, using SNL Financial data. The Texas ratio is commonly used to predict bank failure, and is the amount of non-performing assets and loans, plus loans delinquent for more than 90 days, divided by tangible equity capital and loan loss reserves. If it’s more than 100 percent, that’s trouble.

The number of troubled banks also appears to be increasing. The number of banks with Texas ratios above 100 percent increased 4.5 percent from the third quarter.

The FDIC’s “problem” bank list also appears to be growing. It reached a record high for this cycle of 884 banks at the end of last year, more than 10 percent of the total banking system. That number was up from 860 the quarter before.

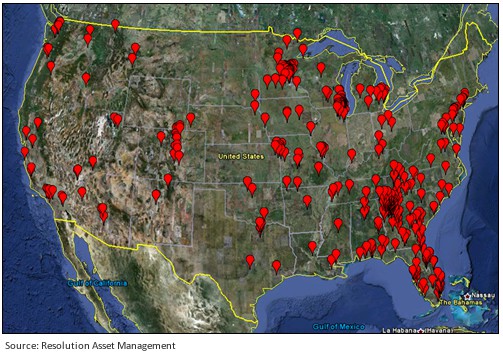

Louis Dubin, president of Resolution Asset Management Co., said the states with the most number of troubled banks are Georgia, Florida, Illinois and Minnesota.

Troubled Bank Map: 2010 Q4

TOTAL BANKS: 417

CRITERIA: Texas ratio > 100%, Leverage ratio <9%

Picking up failed banks from the FDIC offers some benefits: the FDIC can take on as much as 80 percent of the failed bank’s losses, using a tranche system based on the size of the losses. Plus, the acquiring bank can cherry pick the assets, locations and employees it wants. The failed bank’s pre-existing contracts are automatically voided on the sale.

And bankers can get creative in terms of how they structure deals. Brand recommended making several bids, including one that follows traditional FDIC deals and one that doesn’t. For instance, banks can price bids to take into account future risk, instead of using a loss share agreement, avoiding the hassles of regular audits from the FDIC to make sure they comply with the loss-share agreement.

“The FDIC is discovering the costs of auditing all these banks to see what their losses are,’’ Brand said. “Now they’re doing deals without loss share (agreements). You don’t need that expensive accounting system. But they are taking away that safety net, too. If losses are worse than estimated, that’s 100 percent coming out of your pocket.”

One of the drawbacks of FDIC deals is the possibility that the government could change the rules at any time. The loss share agreement lasts a decade for single-family housing assets; five years for commercial properties.

Buyers also don’t have much time to do due diligence. The entire process, from expressing an interest in acquiring a bank, to closing, can take about 90 days, less if the failed bank’s situation is dire.

“They don’t let you wander around the bank talking to all the lending officers,’’ said James McAlpin, an attorney and partner at Bryan Cave in Atlanta.

Bank employees will have to work quickly to make a bid and conduct due diligence. Plus, they must be able to reopen the bank on the Monday after the bank’s Friday closure, and follow timelines to transition the acquired bank and dispose of its assets.

“It is a tremendous strain on your organization,’’ Brand said.