From how-to articles, director training videos, key interviews with industry leaders and more, Bank Services provides bank executives and directors with the tools to help grow their financial institutions.rnrnTo sign up for exclusive access to this online bank board resource, please contact Bank Services at 615-777-8461 or [email protected].

The Consolidation Wave That Wasn’t

The past three years have seen bankers and industry pundits anxiously awaiting the so-called and highly anticipated wave of consolidation in the banking industry. There are many reasons why increased consolidation is expected, including sellers with less access to capital and, therefore, less opportunity to grow independent of a merger, a belief that banks must be larger to compete and absorb the cost of regulation, a lack of organic growth in existing markets, and compressed earnings.

The past three years have seen bankers and industry pundits anxiously awaiting the so-called and highly anticipated wave of consolidation in the banking industry. There are many reasons why increased consolidation is expected, including sellers with less access to capital and, therefore, less opportunity to grow independent of a merger, a belief that banks must be larger to compete and absorb the cost of regulation, a lack of organic growth in existing markets, and compressed earnings.

Despite all of these reasons —some real and some perceived—the pace of consolidation has been modest, at least compared to the predictions of the past several years, begging the question: Where is all the M&A? According to the recently released Bank Director & Crowe Horwath LLP 2013 M&A survey, two of the primary barriers to buying other banks are concerns over credit quality and unrealistic pricing expectations of sellers, both of which we’ll examine in more detail.

Credit Quality Concerns

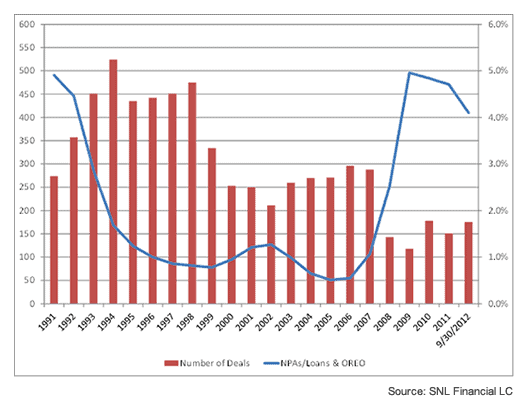

There is a direct correlation between the level of nonperforming loans and the number of deals that are realized. The following graph illustrates the pattern between nonperforming assets (NPAs)/loans and other real estate owned (OREO) and the number of deals announced in any given year. As the graph indicates, when the level of nonperforming assets is high, the number of announced deals is low.

The period most similar to that of the past several years is the early 1990s, when the savings and loan crisis occurred and the government established the Resolution Trust Corporation to resolve a number of failed institutions. Today, the level of nonperforming assets is still too high for many acquirers to accept. While the level has improved from its high in 2010, it is still higher than historical norms. Until loan quality significantly improves, buyers will find it difficult to pay the prices sellers are requiring.

Unrealistic Pricing Concerns

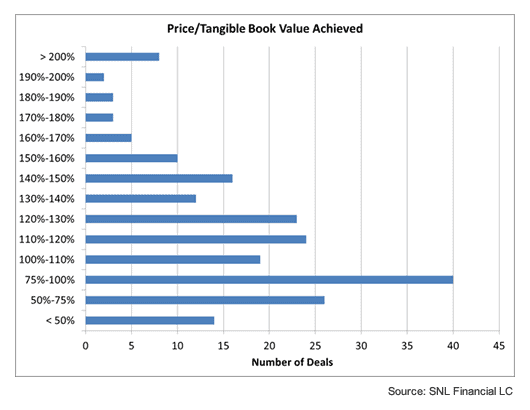

Pricing concerns from sellers is another frequently mentioned reason for deals not occurring. While sellers are not expecting the high levels that occurred pre-crisis, they aren’t willing to sell for a low price. The following graph illustrates the distribution of price to tangible book value achieved by sellers for the period beginning in January 2011 and going through Dec. 7, 2012.

While deal prices have improved and sellers in some regions have been able to achieve prices in excess of 200 percent price to tangible book value, the majority of the deals have closed at below 110 percent price to tangible book value, and almost 40 percent of the deals have been below 100 percent price to tangible book value. For many markets, a price to tangible book value of 140 to 150 percent would be the new “gold standard.” Until this pricing ratio average improves, though, it doesn’t seem likely that the number of deals will increase dramatically.

Looking Ahead

So where will the number of deals be in 2013? Any prediction is worth the ether it’s posted in, but all indications suggest that deal volume will continue to be steady but well below the significant levels of consolidation predicted. Through Dec. 2, 2012, the number of announced whole bank deals was at 209. During the pre-crisis years of the 2000s, the number of whole bank deals per year was approximately 225 to 250. So 2012 will finish with levels below the pre-crisis normative levels, but up from 2011. In the M&A survey, we asked respondents to provide us with their expectations as to where deal volume will be in 2013. The following chart shows that the majority of the respondents believe that deal volume will be less than 200 deals, with 80 percent estimating deal volume will be less than 225 deals in 2013.

|

Deal Volume Expectations for 2013 |

|

|

>225 |

20% |

|

200-225 |

16% |

|

175-200 |

35% |

|

<175 |

29% |

While the wave of consolidation might eventually occur, all indications, including banks’ own expectations, suggest consolidation levels likely will remain status quo for the time being.

You have accessed a resource that is only available to our Bank Services members.

Read The Article

Please enter your username and password bellow. If you have established a password please click ‘forgot your password’