Bank stocks: “It’s really been a lost decade.”

Bank stocks rallied earlier this year but then faltered mid-year in the throng of worries about the European debt crisis.

Bank stocks rallied earlier this year but then faltered mid-year in the throng of worries about the European debt crisis.

“It’s really been a lost decade,’’ said Steve Hovde, the president and chief executive officer of The Hovde Group, an investment bank that focuses on the financial services sector. He was speaking at Bank Director’s Bank Audit Committee Conference this month in Chicago.

Looking at bank stocks going back to 2007, when valuations reached their peak, the U.S. SNL Bank and Thrift index was down about 60 percent through May.

The current global outlook has put a good deal of pressure on bank stocks lately, as well. Even banks that don’t have exposure to European debt are feeling the heat, as the crisis will put a drag on the U.S. economy, Hovde said. And a weak U.S. economy will do nothing for U.S. banks.

“Until we see a healthy economy, we’re not going to have a healthy banking sector,’’ he said. “Until we get employment back, the banking sector is going to have pressure.”

Housing

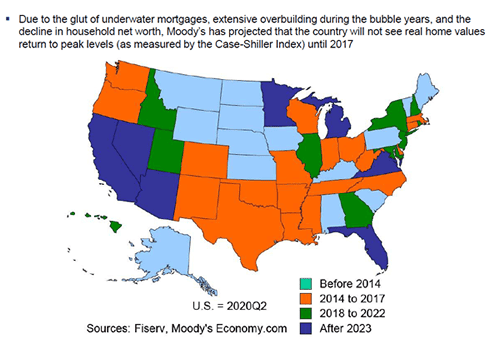

Housing still is a drag on the economy. Moody’s Analytics has predicted that home values, while improving in some markets, won’t return to pre-crisis levels until 2017. Home prices have lost about one-third of their value since hitting a peak in 2006, according to the Fiserv Case-Shiller composite index.

Profits

On the other hand, banks have been getting rid of bad loans and improving their balance sheets. On the credit side, net-charge offs of bad loans are declining, and tangible capital ratios are slowly being rebuilt, Hovde said.

Profitability has improved, as well, as banks reduced their loan loss provisions year-over-year in each of the past four quarters.

Return on average assets has risen to an average of 1 percent in the first quarter of 2012, up from .76 percent in the fourth quarter of last year, according to the Federal Deposit Insurance Corp.

M&A

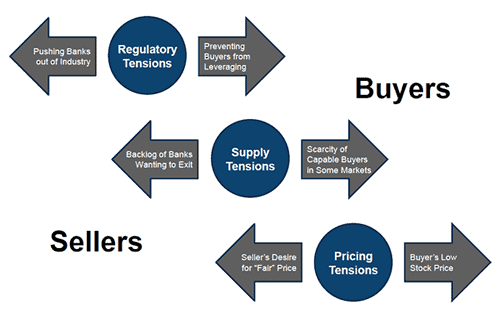

A strengthening bank sector has led to slightly better deal pricing in mergers and acquisitions, but deal volume is still very low.

Uncertainty about commercial real estate and housing values still is hindering deals, as well as the fact that the stock of many buyers and sellers’ is trading below book value, Hovde said.

The glut of failed banks could also be putting a crimp on deals in some markets, and Hovde predicted that the Chicago area alone will probably have another 10 to 15 bank failures. Nationwide, there were 403 banks with a Texas ratio greater than 100 percent as of March 31, according to SNL Financial LC. A Texas ratio greater than 100 is an indicator of potential failure. There were 59 banks with a Texas ratio greater than 300 percent, and 36 of them are in the Southeast.

Still, the pace of bank failures has slowed and many buyers are beginning to turn their focus to non-FDIC assisted deals, he said.

“With M&A I think we’ve probably hit the bottom and will probably see it pick up absent another global financial crisis,’’ Hovde said.