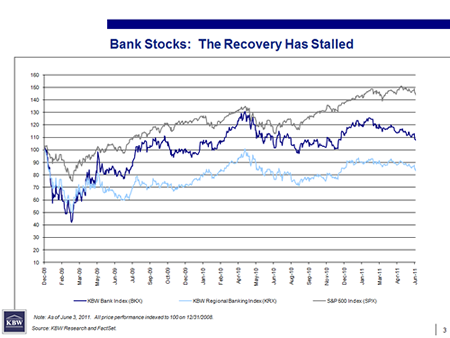

Why bank stocks are performing so badly

You can almost hear the wind come out of the recovery.

John Duffy, the chairman and CEO of investment bank Keefe, Bruyette & Woods gave his update on the state of the banking industry at Bank Director’s Bank Audit Committee conference in Chicago June 14, and it wasn’t a pretty picture.

As of early June, the recovery in bank stocks has stalled. This, despite the fact that 63 percent of bank stocks tracked by KBW beat analyst expectations in the first quarter.

That’s quite a change from the depths of the recession, when 73 percent of banks missed analyst expectations, back in the fourth quarter of 2008.

“I think there is some credibility being established between analysts and bank management, but unfortunately, the economic news is not always good,’’ Duffy said.

Credit quality has improved but non-performing assets still are high. Deposit growth has slowed dramatically. And even the biggest banks, which were more aggressive than the regional banks in terms of provisioning for bad loans, don’t have much room for growth.

“As you shrink the balance sheet, it’s hard to replace those assets,’’ Duffy said. “I think a lot of the optimists have now gone to the sidelines and are less convinced that the economic recovery is going to continue and that obviously has implications for loan volume in the banking industry as well as credit quality.”

Duffy said bank stock analysts are probably going to be focused on the fact that net new non-accruing loans (non-performing loans whose repayment is doubtful) rose in the first quarter for the first time in six quarters.

With all the loan problems and regulatory pressure, investment bankers such as John Duffy, who depend on M&A as their bread and butter, having been predicting a coming wave of consolidation. It hasn’t happened yet.

With just 60 traditional, non-FDIC-assisted acquisitions this year through June 3, valued at about $3 billion in total, Duffy said he thinks it’s been difficult to raise capital, especially for banks below $1 billion in assets. Plus, there’s a lack of potentially healthy buyers in regions with a lot of hard-hit banks.

“We should think there are at least a couple hundred banks that are not going to make it,’’ he said. “For the banks that are healthy, we continue to think this remains a real opportunity.”